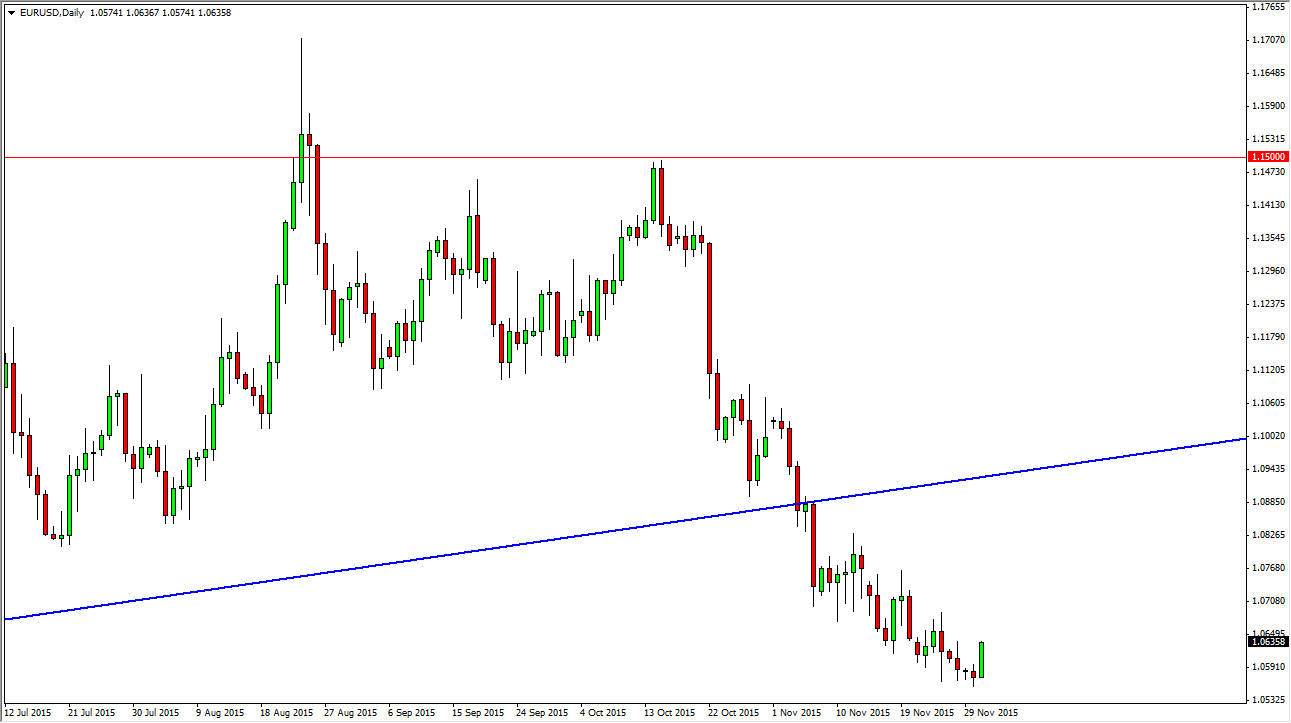

EUR USD Clears 1.06 Handle

The EUR/USD pair broke higher during the course of the day on Tuesday, clearing the 1.06 handle by the time we closed out the American trading session. This is a fairly impressive and strong candle, but ultimately I believe it’s only a matter of time before the sellers reenter. I see quite a bit of noise just above, and breaking below the now well-known ascending trend line was of course a very nasty sign as well. With all of the volatility above, I think it’s only matter of time before the sellers get involved and push this market lower.

Even with the bullish candle, I think at best this is going to be a bit of a relief rally, and it’s only a matter of time before we get bearish pressure yet again. I believe I know when that pressure could return.

Friday

I believe that Nonfarm Friday could be a big event as the jobs numbers come out of the United States. It is assumed that the Federal Reserve may have to raise interest rates sometime this month, if not in January. If the jobs number is stronger than anticipated, it will all but ensure that. I think what we are about to see is a bit of a bounce in this pair, followed by downward pressure. I still believe that the 1.05 level is the target over the longer term, so this point in time I have no interest in buying. In fact, I would not be interested in buying this pair until we broke well above the uptrend line which would have this market looking for something like 1.10 at the moment.

I think we can get below the 1.05 level given enough time, and if we do we may finally make a move towards parity, which seemed so absurd when I first started hearing that 9 months ago. However, it wouldn’t be the first time these 2 currencies have been equal in value, although I a highly doubt most of you would have been trading back then.