CAD/CHF is a pair that a lot of you probably don’t pay attention to, but I actually like this one as it features two major currencies, and it is a bit of a “backdoor” play on those currencies. You eliminate the US dollar and the Euro, which of course has quite a bit of volatility built into that particular trading pair. I think that it’s an interesting pair to trade as the Canadian dollar is so highly influenced by oil, but at the same time the Swiss franc is highly influenced by what is going on in the European Union, and more specifically at the Swiss National Bank.

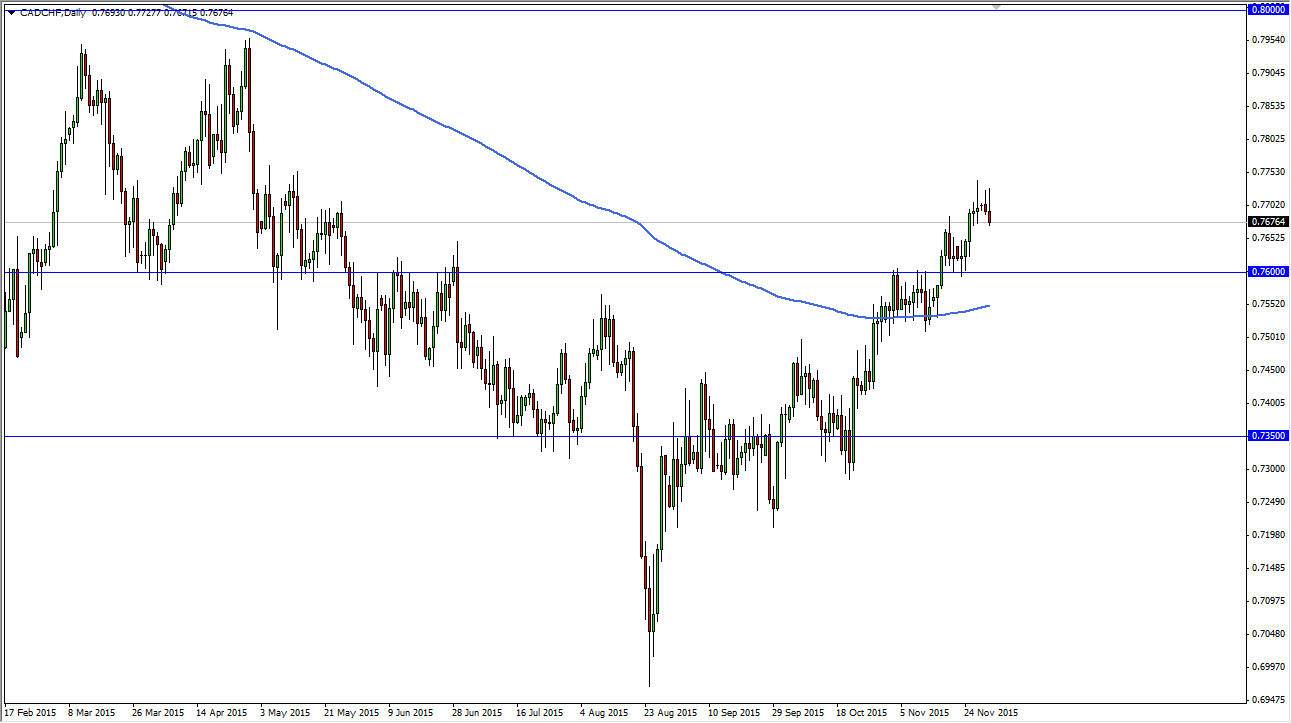

As you can see, we have been rising for some time in this pair, and have seen a significant uptrend since the end of August. Unlike in the EUR/CHF pair, which is one of the major ways traders tend to play the Swiss franc, this pair does not have the downdraft attached to it that the Euro does due to the fact of the economic situation in the European Union, and of course the European Central Bank.

Because of this, it is quite common to see a lot more fluidity in these types of markets as it eliminates a lot of the excess noise and quite frankly attention that is paid by most of the traders out there.

Oil

Granted, oil tends to influence the Canadian dollar more than anything else, and while oil markets are not helping it, the fact is that we find oourselves in an uptrend line and have recently climbed above the 200 day moving average. This tells me that the market is paying more attention to the Swiss franc, and the potential intervention by the Swiss in the markets than it is oil itself. Yes, the USD/CAD pair looks pretty rough on the Canadian dollar, but at the end of the day the Canadians have the Americans to export to, while the Swiss are stuck with the Europeans. Ultimately, both better for Canada than Switzerland. Because of this, I believe that we are going to roll over a bit, but should find support somewhere closer to the 0.76 level that we can buy.