By: DailyForex.com

AUD/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be entered between 8am and 10am New York times today.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7200.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

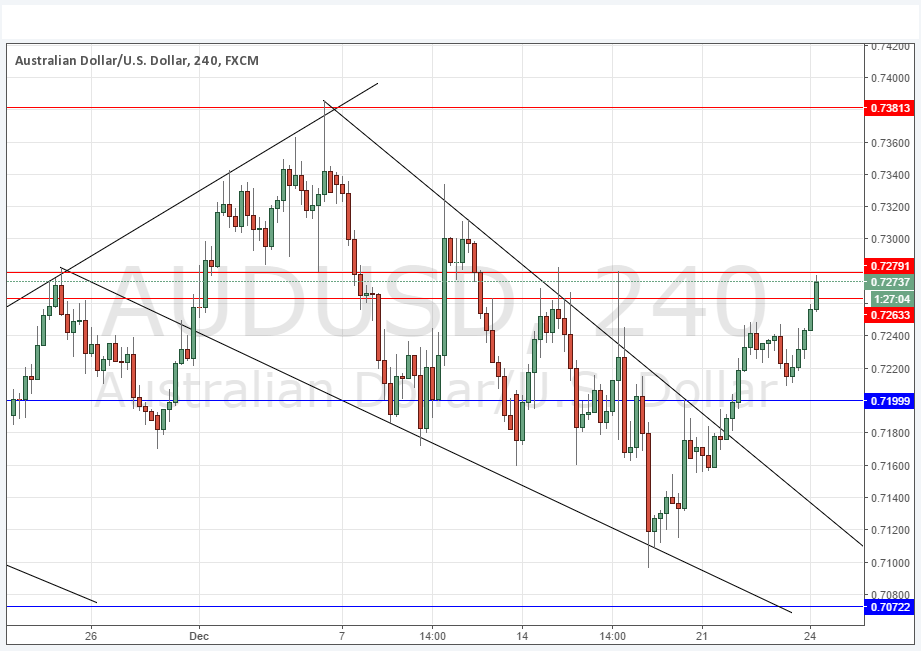

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 0.7263 and 0.7279.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

This pair has begun to rise quite strongly as the USD has come under pressure over the past few days. We can see that there is a kind of strength in the AUD and NZD currencies that keeps asserting itself every time the USD takes a break.

The rise looks strong and healthy but is running into resistance now that it has entered the resistant zone between 0.7263 and 0.7279. If the price cannot rise and instead turns around here and begins to fall coincident with the New York open, this could be an opportunity for a short trade, but it might be better to try to exploit a strengthening USD against currencies such as CAD or GBP which are much weaker.

There is nothing due today concerning the AUD. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.