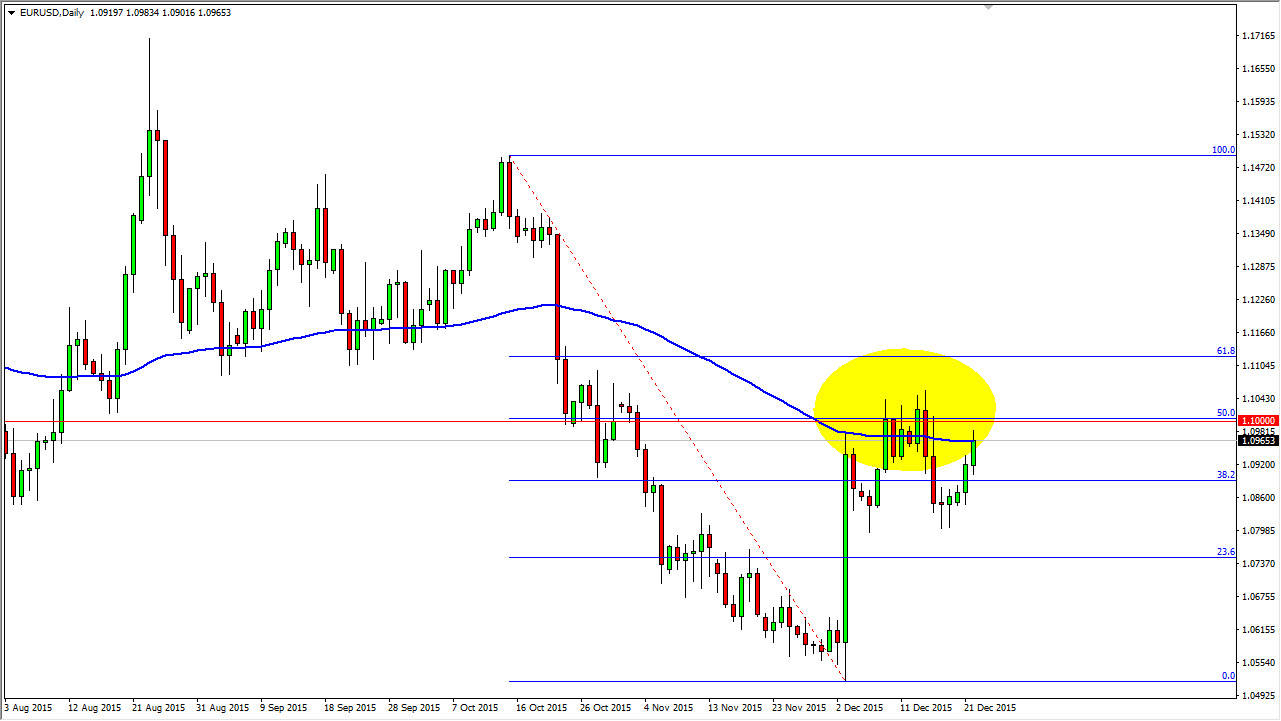

The EUR/USD pair rose during the course of the session on Tuesday, reaching towards the 1.10 level. I see several different things going on in this general area, and as a result I think that a trading opportunity may present itself. As you can see on the chart, I have a yellow highlighted area that signifies where I want to place a trade.

To start with, the 1.10 level is a significant round number. I feel that the round number of course will attract traders as it typically does. Most support and resistance is found at major round numbers, and of course the 1.10 level is certainly major. On top of that, we have the 100 day exponential moving average sitting right here, and as a result I feel that longer-term traders will probably get involved as well. Finally, we have the Fibonacci retracement level, which coincides nicely with the 1.10 handle. At that level, the 50% Fibonacci retracement level lies. Above there, at the 1.11 level, the 61.8% Fibonacci retracement level sets. Because of this, I feel it somewhere in that general vicinity the sellers should get involved.

However, the 1.11 Level Matters

If we can break above the 1.11 level, I feel that the market then will try to reach towards the 1.14 level. So, having said that, I do have a contingency plan in case the buyers want to push through all of this area. However, I think that if we get an exhaustive candle in this area, we could very easily drop back down to the 1.08 level. That is the bottom of the consolidation area, and as a result I feel that would be a very easy move.

However, we could also break down below the 1.08 level, and if we do the market then will reach towards the 1.05 level given enough time. It’ll be interesting see what happens, because the European Central Bank looks likely to add stimulus, or at least threaten it. The Federal Reserve of course has recently increased interest-rates, and could very well do so again if the announcements require them to.