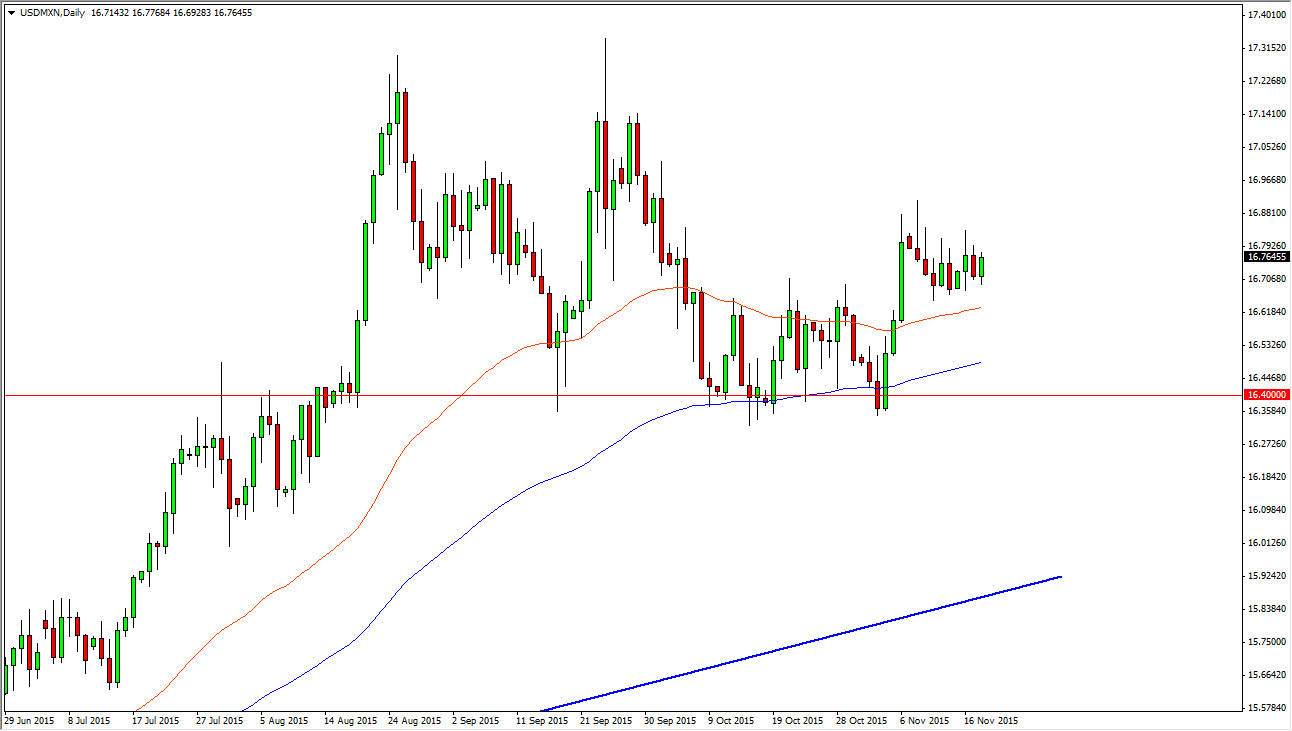

The USD/MXN pair initially tried to fall during the day on Wednesday, but the 16.70 level continues to attract buyers as this market is currently grinding sideways. However, when you look at the chart, you can see that we have recently broke above the 16.70 level, which had been resistive previously. With this, I feel that we are simply trying to establish support where there was previous resistance, and that it’s only a matter time before we climb higher.

You can see that I have two moving averages on this chart, a red and a blue line. The red line represents the 50 exponential moving average, while the blue line represents the 100 exponential moving average. With this, if the keep in mind that the 50 day exponential moving average is considered to be the “fast moving average” by a lot of longer-term traders. You can see that we are broken above there and are now starting to see a bit of dynamic support. Previously, the 100 day exponential moving average is what started the support at the 16.40 region as far as that is concerned. Because of this, I do believe that we will continue to go higher.

The Importance of Petroleum

On top of that, you have to keep in mind that the Mexican peso is considered to be a proxy for oil, and Latin America. Right now though, I believe that we are focusing more on the oil part of the equation, as well markets are falling apart. There are a lot of Mexican oil rigs in the Gulf of Mexico, but right now they aren’t as profitable as they once were. As long as the commodity markets look soft, I believe that the Mexican peso will as well. On top of that, if the keep in mind that the US dollar is the favored currency at the moment, and that of course works against Third World currencies. With this being the case, I don’t see the reason why we don’t go higher.