The NZD/CAD pair is a market that I’ve been paying attention to recently. While they are both driven by moderate easing general, the reality is that certain commodities are going to be more sensitive to economic conditions at the moment than others. For example, the crude oil markets look absolutely horrible and that of course works against the value of the Canadian dollar as Canada exports so much petroleum around the world.

On the other side of the equation as the New Zealand dollar, which shows quite a bit of sensitivity to general appetite for commodities overall, and then of course Asian demand for commodities as New Zealand sends so many to the mainland. Given enough time, I believe that this is essentially an “agricultural commodities versus crude oil” type of trade, and clearly this market looks as if it favors the agricultural sector.

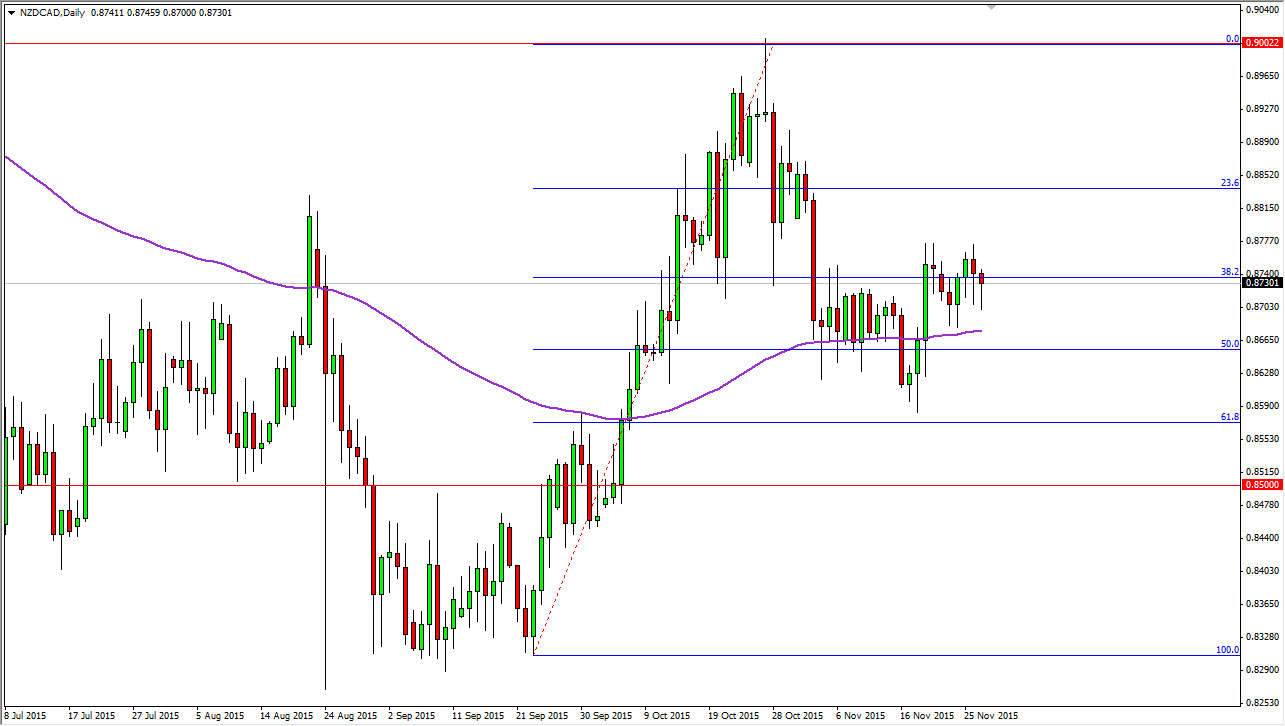

Multiple Hammers

As you can see, we are for multiple hammers, and have bounced off of the 61.8% Fibonacci retracement level previously. Because of this, the market looks like it is ready to go higher, and we also have the 100 day exponential moving average just below. I do think that it’s only a matter of time before we grind away much higher, probably reaching towards the 0.90 level again. With this, I am a buyer on a break above the top of the consolidation range that we are in, as I would add to my already long position. In fact, I believe that this could be a nice trend trade given enough time, but you are going to have to be patient as although this market looks well supported, the reality is that this is a market with a lot of moving parts.

Typically, a lot of moving parts means a lot of volatility, but in this case it seems to be more or less a case of “this currency isn’t as bad as the other one.” With that type of trading, you have to be patient.