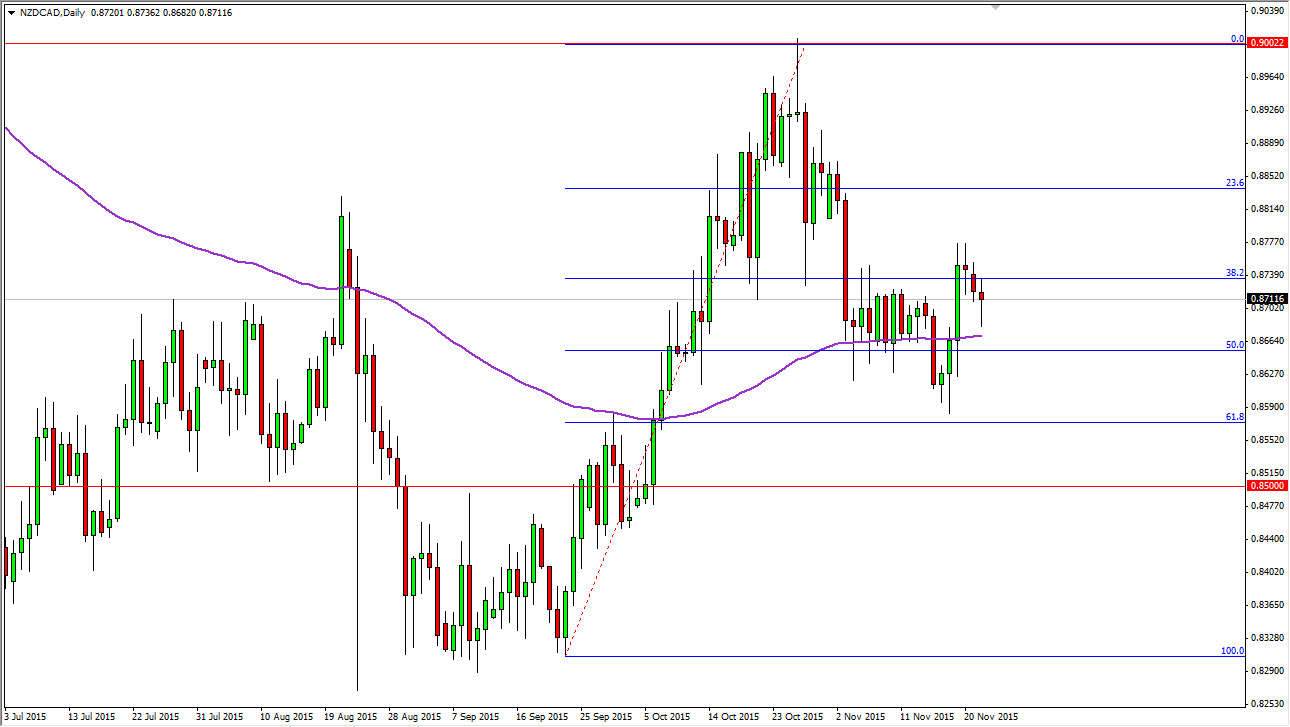

The NZD/CAD pair went back and forth during the day on Monday, but found enough support below to turn things back around and form a bit of a hammer like candle. This is an area that has seen quite a bit of support anyways, and of course I have marked the 100 day exponential moving average on this chart. You can see it has offered quite a bit of dynamic support lately, so I believe that after the initial shot higher, we have pulled back to find more support and buyers below.

If we can break above the top of the range during the session on Monday, the market should continue to go much higher, probably reaching towards the recent high at the 0.90 level. Keep in mind that although both of these are commodity currencies, the reality is that the Canadian dollar is almost solely a proxy for crude oil. The New Zealand dollar on the other hand can be influenced by a couple of different things, not the least of which is the Asian economy, as well as interest-rate differential and overall commodity attitude.

Interest-Rate Differential

Speaking of interest-rate differential, you have to keep in mind that the Royal Bank of New Zealand has set interest rates higher than the Bank of Canada, and that of course will continue to influence this market to the upside. With this, I believe it’s only a matter of time before this market reaches those highs again, but I’m not foolish enough to expect this market to move up there in an easy manner.

It’s not necessarily that I like the New Zealand dollar itself, it’s more that I think the Canadian dollar is worse. With this, this market should continue to find buyers every time it pulls back, and I believe that we are destined to break out above the 0.90 level. With that, you have to believe that the Canadian dollar is in serious trouble.