Gold prices ended Tuesday's session down 1.48%, or $12.43, to settle at $1070.11 an ounce as a rally in the dollar fueled downside momentum. The XAU/USD pair had a fourth straight weekly loss, pressured by mounting expectations that the U.S. central bank is on course to begin altering its monetary policy. In economic news on Tuesday, the Labor Department reported that consumer prices climbed 0.2% and Federal Reserve said industrial production dropped 0.2% in October.

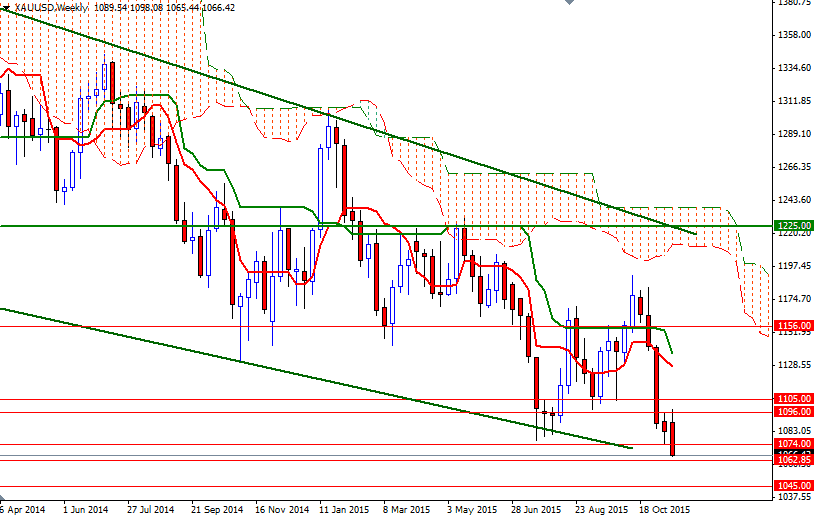

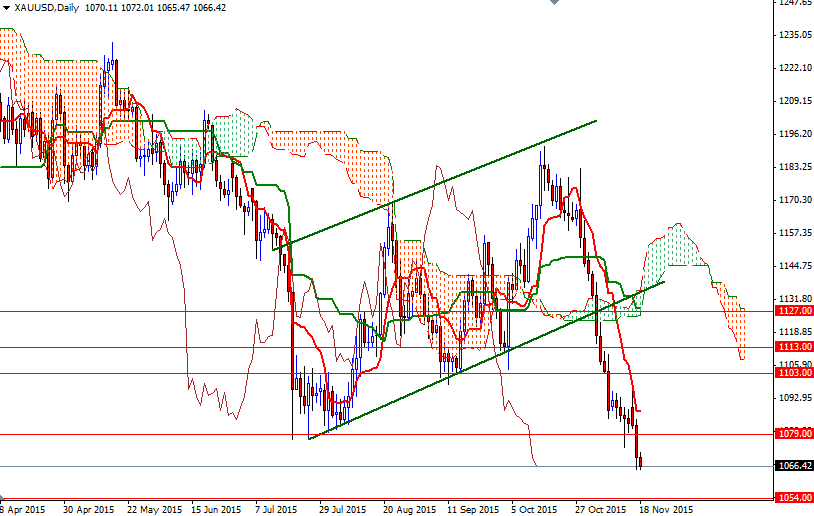

Market participants will be eyeing the minutes of the Fed's October meeting, due to be released later today, for clues on policy makers' opinion on the economy. Not surprisingly, the XAU/USD pair extended its loses after demolishing the support at 1079 and traded as low as 1065.44. The technical picture for gold (based on the weekly, daily and 4-hourly charts) is weak, with the market trading below the Ichimoku clouds, as well as negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. Adding to the bearish outlook is the Chikou-span (closing price plotted 26 periods behind, brown line) which indicates a solid momentum.

As pointed out in previous analysis, the 1062.85 level down below is a key support and it may hold at least ahead of the FOMC meeting minutes. If the downward pressure continues and 1062.85 is convincingly broken, the 1054 level will be the next port of call. Falling through this support could encourage sellers and increase the possibility of an attempt to visit the 1045 level. However, if prices turn bullish, there will be hurdles such as 1076/4 and 1079. A break up above 1079 could trigger a retracement towards 1089/7.67.