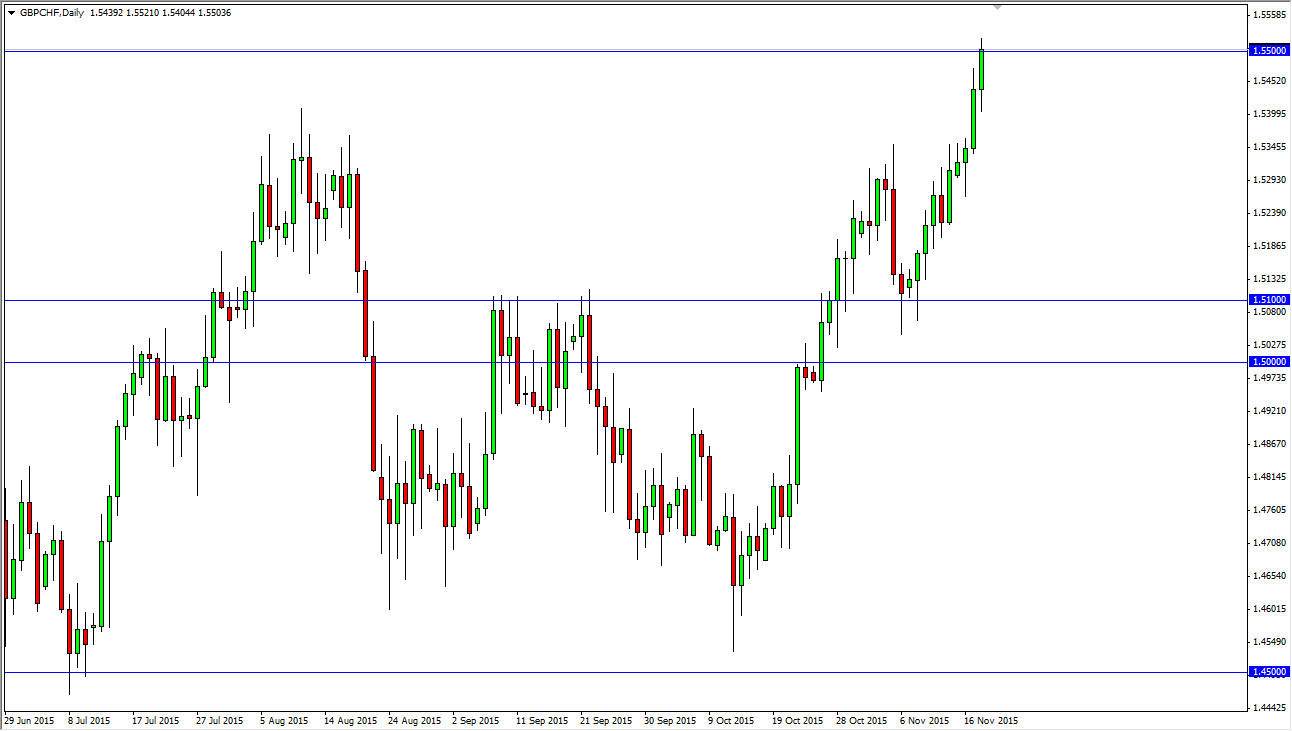

During the session on Wednesday, the GBP/CHF pair initially fell, but turned back around to find quite a bit of bullish pressure as the 1.54 level offered more than enough support. Looking at this chart, the market should continue to go higher if we can break above the top of the range for the day on Wednesday. The markets are a bit overextended at the moment, so I would not be surprise at all to see a little bit of a pullback before we finally break out above this area. However, the one thing that does strike me the most about this chart is the fact that we are starting to see the Swiss franc lose value around the world. The British pound isn't exactly the strongest currency at the moment right now, but it is absolutely decimating the Franc.

In The End, This Is About Europe

I believe that this is simply an expression of the concern about the Swiss economy as it is so highly leveraged to the European Union. Yes, the British trade with the Europeans a lot as well, but they also have a little bit more of an expanded trade radius, and as a result it makes sense that the British pound would do better than the Euro, and the Swiss franc. The Swiss unfortunately are landlocked when it comes to the European Union, and send 85% of their exports into the region. As long as their troubles in Europe, there are troubles in Switzerland, regardless of what anybody tells you.

I believe pullbacks are buying opportunities anyways, so even if we fall from here, I would be interested all the way down to roughly 1.53. As long as we can stay above there, I believe the buyers will eventually push this market above the 1.55 handle, and then towards the 1.58 level which is my longer-term target at the moment.