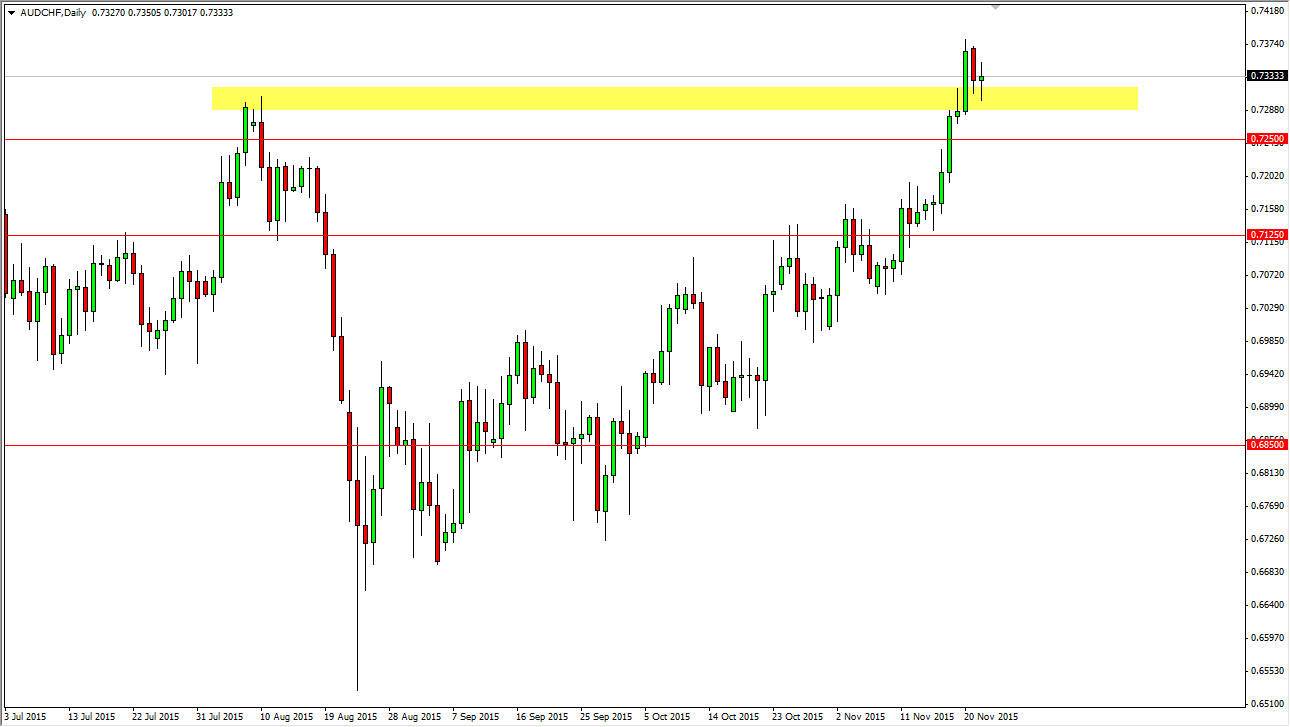

The AUD/CHF pair went back and forth during the course of the day on Monday, as we have recently broken out, and then pulled back looking for support at the previous resistance. The 0.73 level looks to be support, so the fact that we formed this neutral candle isn’t much of a surprise. If we can break out above the top of the range for the day, I feel that this market will probably reach towards the 0.75 level given enough time.

While I do not like the Australian dollar itself, the reality is that the Swiss franc is selling off against almost everything out there. You can see that this pair has been in a nice uptrend for some time now, so I believe this will just be a simple continuation of that. I think that it’s only a matter of time before we reach the 0.75 level yet again, and as a result it’s only a matter time before the buyers step back into this market as far as I can tell.

Swiss National Bank

The Swiss National Bank continues to work against the value of the Swiss franc in general, so having said that it’s only a matter of time before the market punishes the Swiss franc again and again. I believe that the Australian dollar of course will be somewhat hindered by the gold markets, but quite frankly I feel that the trouble in Europe far outweighs what’s going on in the commodity markets.

The Swiss of course are beholden to what goes on in the European Union, as the Europeans are by far the largest customers. With this, I believe that anytime the Swiss franc strengthens, you have to be suspicious of that move in general. The Australian dollar, while not being the strongest currency from my perspective, the reality is that it’s not the Swiss franc. Sometimes, that’s enough.