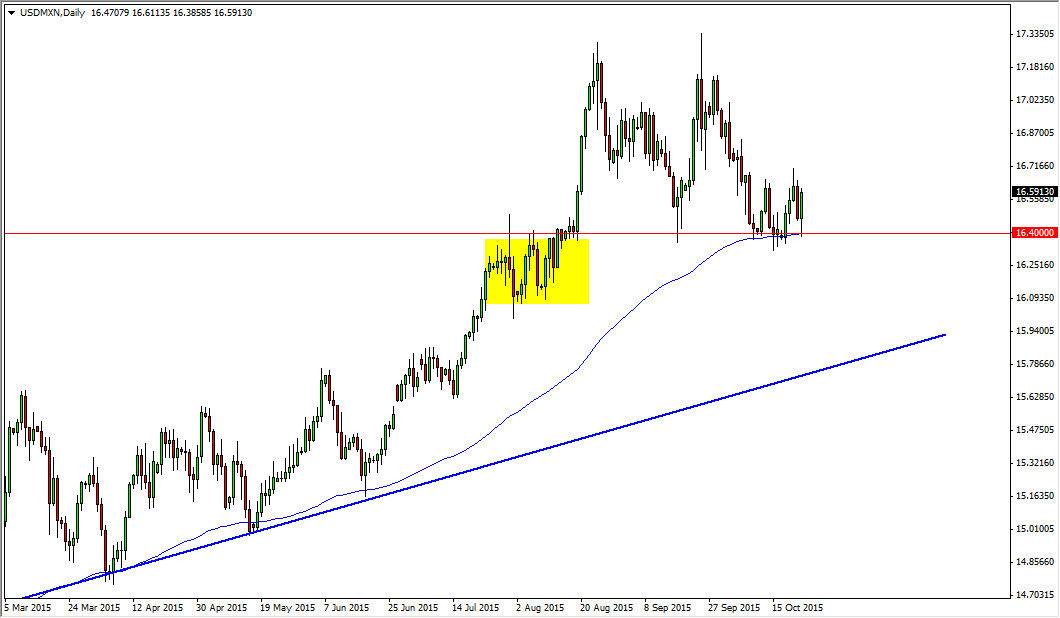

The USD/MXN pair fell initially during the course of the day on Friday, but found enough support near the 16.4 level to turn things back around and bounce. That bounce of course formed a bit of a hammer, and as a result it looks like we’re going to continue to find buyers in this general vicinity. With that, we look at pullbacks as buying opportunities and also recognize that the area below the 16.40 level has quite a bit of noise that should now offer support. On top of that, we have the 100 day Exponential Moving Average just below which of course is a favorite of the longer-term traders out there. Ultimately, this market should continue to go much higher, and then reach towards the 17 level.

Mexico means oil

Remember that the Mexican peso is more or less a proxy for the oil markets. The oil markets look a bit soft at this moment in time so this market should continue to go much higher. Ultimately though, this is a market that will find buyers sooner or later, and that of course makes sense as the US dollar has been strengthening so much. The crude oil market of course has to be watched, but having said that it’s only a matter time before the general US dollar strength should come into play. This is a market that has been very strong for quite some time, and quite frankly right now I feel that we are essentially going sideways. Do not be confused though, we are still very much in an uptrend.

Ultimately, I think that you have to ignore the large spread, simply because the pip value is so small. Keep that in mind, as the market should continue to go higher and therefore you have to have a bit of faith. A spread of 50 or more pips is in exactly out of the ordinary, but with the pip value being so small, what you need to do is adjust your position size. Have to think in terms of hundreds of pips, not just a few.