USD/CAD Signal Update

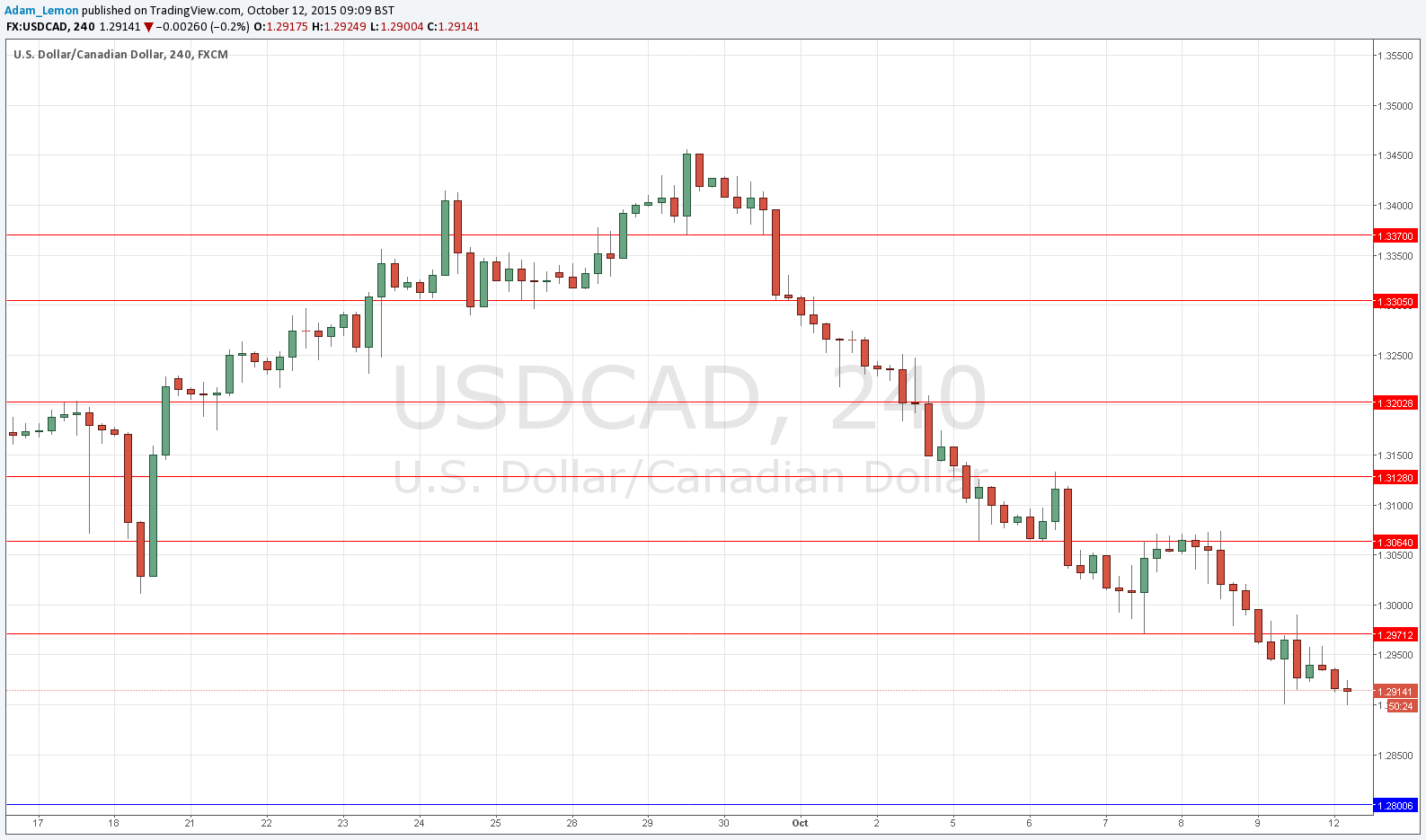

Last Thursday’s signals did not quite provide a short trade, but the forecast of 1.3064 being probable resistance was highly accurate.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm New York time today.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2800.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2971.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3064.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

As can be seen from the chart below, this pair just keeps falling strongly, and is one of the strongest-moving currency pairs. This is partly due to the strengthening Canadian economic news and rising price of oil (currently trading at over $50 per barrel), and partly to the weakening USD which is looking more and more as if it is not going to see any rate rise until well into 2016.

In this atmosphere any long trade is a very risky proposition, although there is a very long-term bullish trend. However this movement does look like more than a simple pull back, so the best option will probably be to look for short opportunities at resistance only.

Concerning the CAD, the Governor of the Bank of Canada will be speaking at 6:20pm London time. It is a public holiday today in both the USA and Canada.