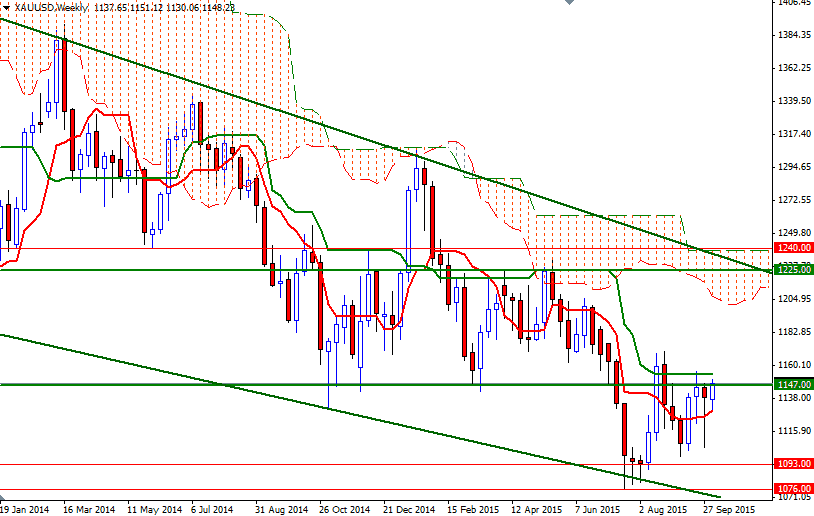

Gold resumed its rise on Tuesday, after taking a breather on Monday, as weakness in the dollar bolstered demand for the precious metal. The XAU/USD pair has advanced nearly 4% since the market bounced off the $1104 level and currently hovering just above the $1147 level. Gold's gains were helped by growing expectations that the Federal Reserve will hold off on rate increases.

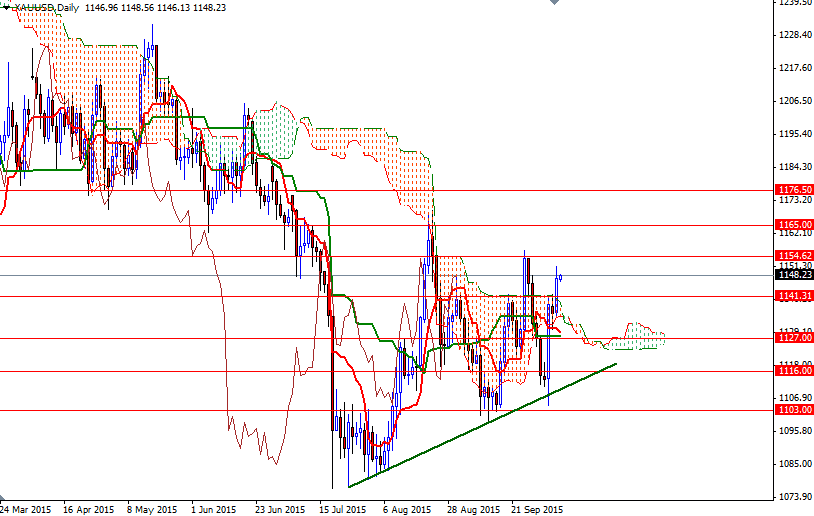

Given the weakness in the economic data lately and volatility in financial markets, the U.S. central bank may choose to make its first move in early 2016. On the daily and 4-hour time frames, the XAU/USD pair is trading beyond the Ichimoku cloud and we have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses, indicating that we have more pressure from the bulls than bears in the short-term. From a technical standpoint, there is the possibility of further price gains, if the market holds above the 1147 level.

In that case, the XAU/USD pair will probably proceed to the 1154.62 resistance level which blocked the bulls' way last month. The bulls will have to break through that barrier so that they can march towards 1165. On the other hand, if the bears manage to defend their ground and push the market back below 1147, then 1141.31 - 1140 could be the next stop. Below 1140 look for further downside with 1134 and 1129/7 as targets.