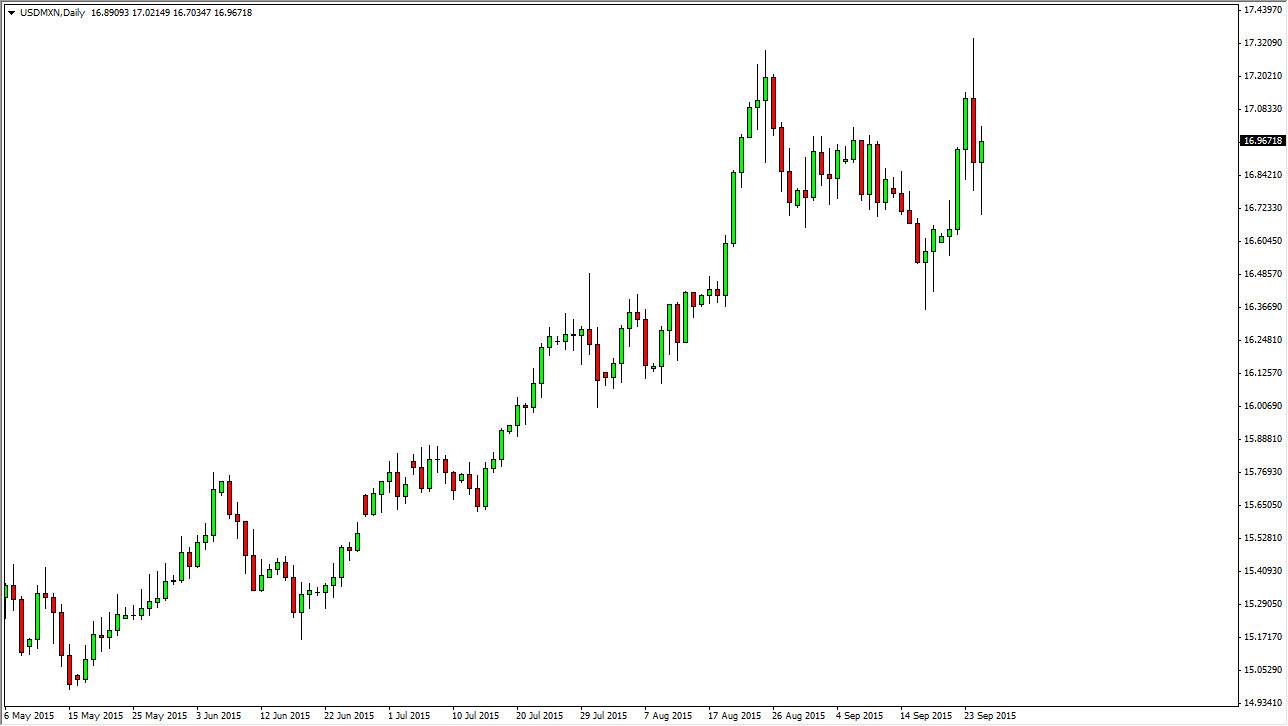

The USD/MXN pair fell initially during the course of the day on Friday, but found support near the 16.70 region. Because of this, we bounced enough to form a massive hammer, and it now appears that the market is ready to continue going higher. This would not be much of a surprise, because there is a serious concern about global markets right now by the Federal Reserve. While they have been known to be wrong, traders do tend to follow what they say. If they are concerned about global markets, especially emerging markets, it makes sense that people do not trust Mexico. On top of that, if you mind that we are in the midst of a very nice uptrend. It makes sense that we would follow the same trajectory higher and now the buyers will be looking to pick up “value” in the US dollar going forward.

Oil

Ultimately, if you mind that the Mexican peso is highly correlated to the price of crude oil. This of course is because many of the oil rigs in the Gulf of Mexico are actually Mexican not American. Granted, the Americans are starting to produce more of their own oil, but at the end of the day most traders will use the Mexican peso as a proxy for not only Latin America, but the petroleum markets themselves. As the price of oil falls, it makes sense that demand for the Mexican peso does as well.

In general, I do not like buying the Mexican peso because of various socioeconomic and of course political problems in that country. Most people will prefer to hold US dollars than Mexican peso is, unless of course the oil markets turn around. At that point in time, things could change drastically. However, you should keep in mind that with the Americans are producing more of their own oil these days, even if oil markets to turn around, this pair may not collapse like it had in the past. I continue to buy pullbacks in this pair.