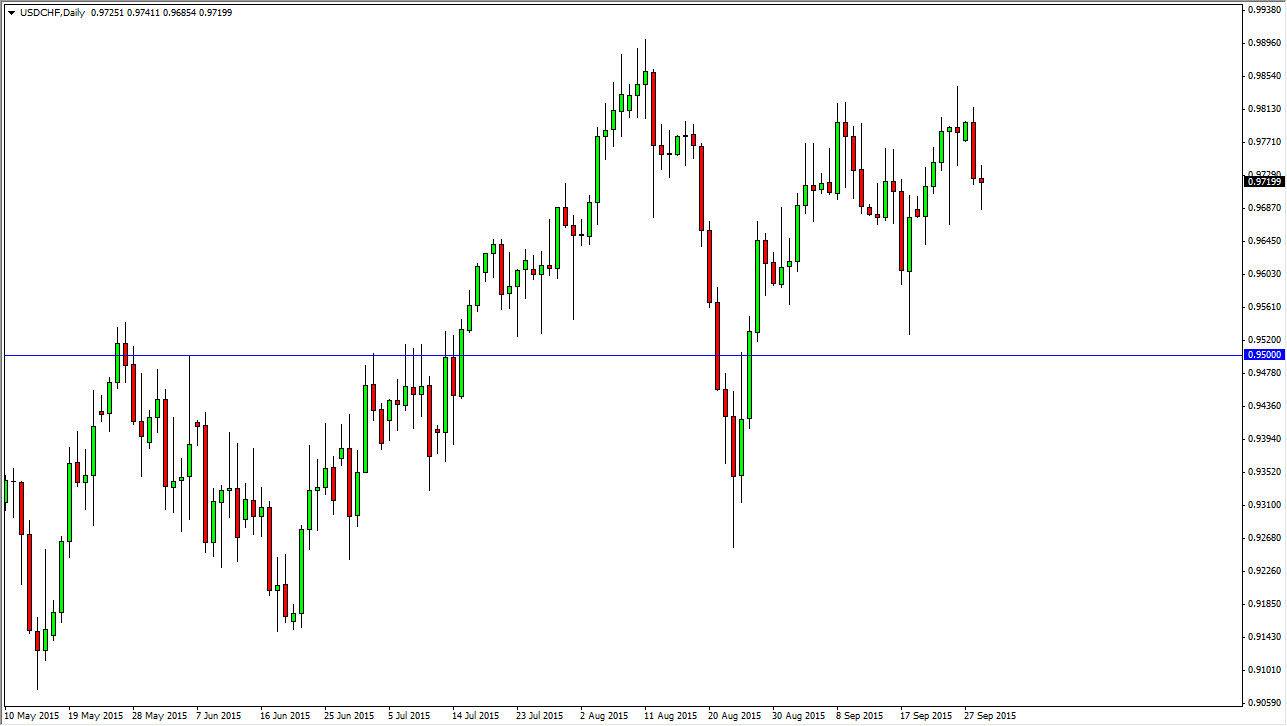

The USD/CHF pair initially fell during the course of the day on Tuesday, but found enough support below to turn things back around and form a nice-looking hammer. I think that this hammer suggests that this market will continue to go higher, and that the buyers are still most certainly in control of the currency pair at the moment. I believe that if we can break above the top of the hammer, this market should then reach towards the 0.99 level yet again. This is a market that of course features the Swiss franc, and that is a currency that’s been worked against buying its own central bank. As long as that’s the case, I do not have any interest in buying the Swiss franc against anything, let alone the US dollar which of course is well supported by all of the concerns around the world at the moment.

Buying pullbacks

I think that the best thing that you can do in this market is to buy pullbacks, just as we have seen over the last couple of sessions. Ultimately, even if we break down from here though, I would not be interested in selling, simply because there is more than enough buying pressure over the longer term to keep this market going higher. In fact, I fully anticipate seeing this market go to the parity level fairly soon, and perhaps even higher than that. Once we break above the parity level, we could go much higher.

The paradox of this currency pair at the moment is the fact that the Swiss franc is probably one of the few currencies that is considered to be “safer” than the US dollar, under normal circumstances. After all, a lot of times this pair will fall when there is a lot of risk in the global marketplace, as the Swiss franc is considered to be one of the safest currencies to own. However, now that the European Union continues to struggle in general, that of course has a knock on effect to the Swiss economy. I believe that the market will continue to grind higher simply because of that fact.