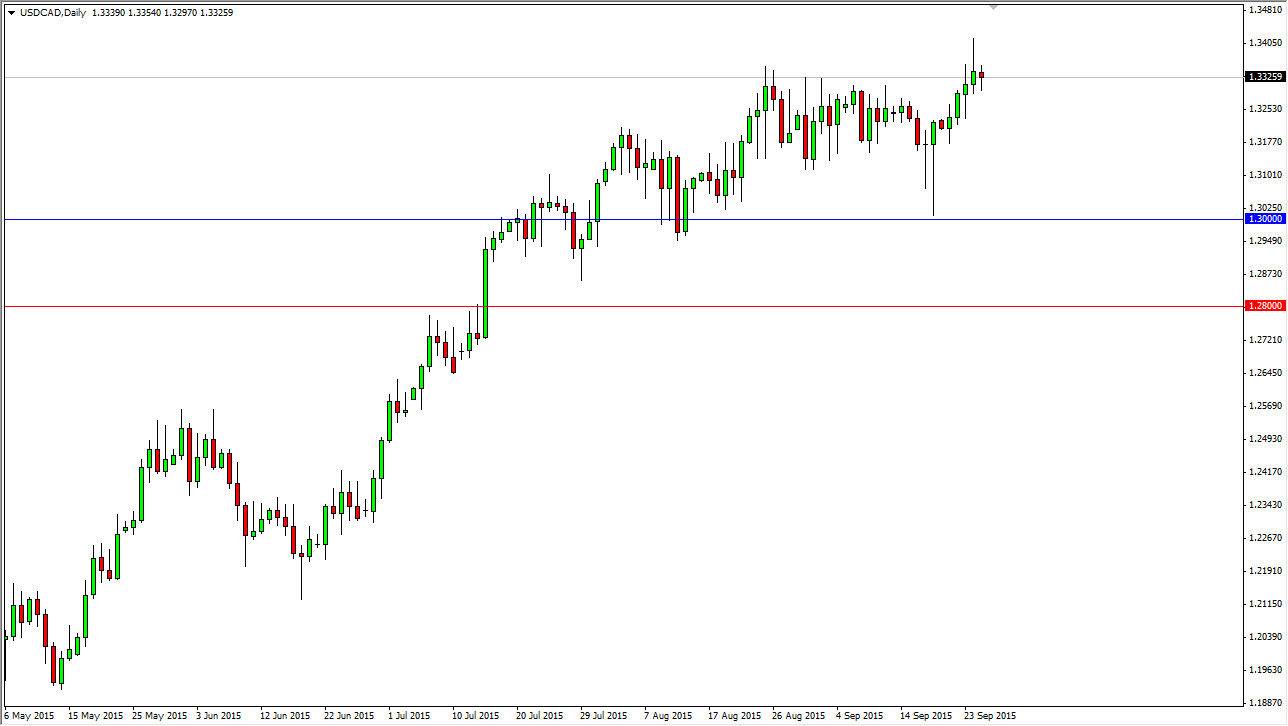

The USD/CAD pair went back and forth during the course of the day on Friday, essentially settling on a very neutral candle. That being the case though, you have to keep in mind that the Thursday candle was indeed very negative. After all, we reached towards the 1.34 level but then turned back around to form a shooting star. That shooting star of course is a very negative sign and suggests that perhaps we could go lower. Ultimately though, I prefer to look at the longer-term scenario, and the fact that we pulled back from that shooting star at the 1.34 level only tells me that we do not have enough momentum to keep going higher yet.

I say this because the market has been in such a nice uptrend for so long, and of course we broke out above the vital 1.30 level which I have marked in blue on my chart. This was an area that was massively resistive previously, and during the financial crisis pushed back against the buyers several times. With that, the resistance was massive, and then eventually the pair fell apart.

Don’t forget oil

On top of all of the technical reasons that you could make for this market to continue going higher, you cannot forget the fact that the oil markets aren’t exactly humming along at the moment. Yes, we have seen a nice bounce in the value of WTI Crude Oil, but at the end of the day it is still a small blip in what is a massive downtrend. Quite frankly, the oil markets have been absolutely decimated, and that of course has put quite a bit of pressure on the Canadian dollar, not only for the reason that the oil markets are falling, but also the fact of the Canadian economy been so sensitive to oil in general. As long as oil markets are fairly soft, there’s really no way this pair breaks down. I am buyers of pullbacks again and again.