Gold prices ended the week down nearly 1% as increasing demand for the American dollar curbed the metal's appeal as an alternative investment. The XAU/USD pair touched the lowest in two weeks on Friday after the Labor Department said the unemployment rate dropped to 5.1%, a level that the Federal Reserve considers to be full employment, and average hourly earnings climbed 0.3%. Headline job creation was definitely disappointing but the upward revisions which added a total of 44000 jobs to overall payrolls in the previous two months and the level of fulltime employment offset that weakness.

The Fed has signaled that it’s likely to raise rates this year but concerns over slowing Chinese growth and volatile global financial markets muddy the argument for a rate hike this month. A week ago, Fed Vice Chairman Stanley Fischer said "We are following developments in the Chinese economy and their actual and potential effects on other economies even more closely than usual". They have less than two weeks before they make the decision so they will pay even greater attention to global market developments. Absence of key US data this week will shift the focus to stocks on major markets.

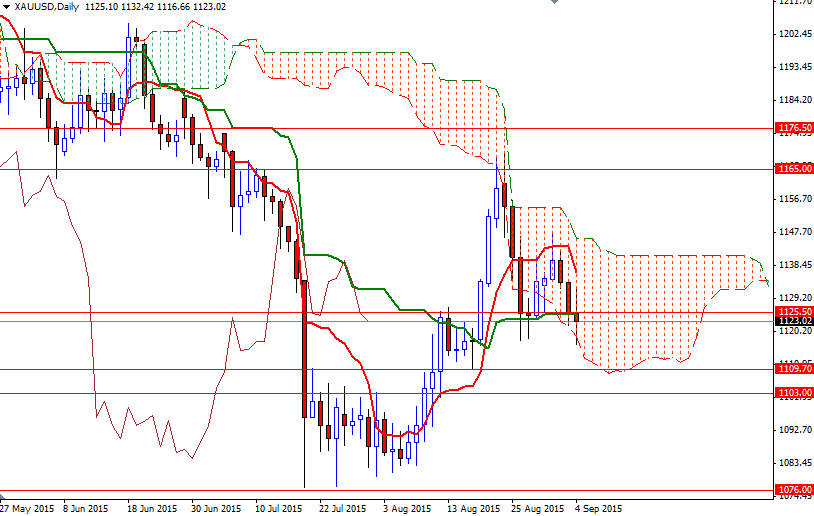

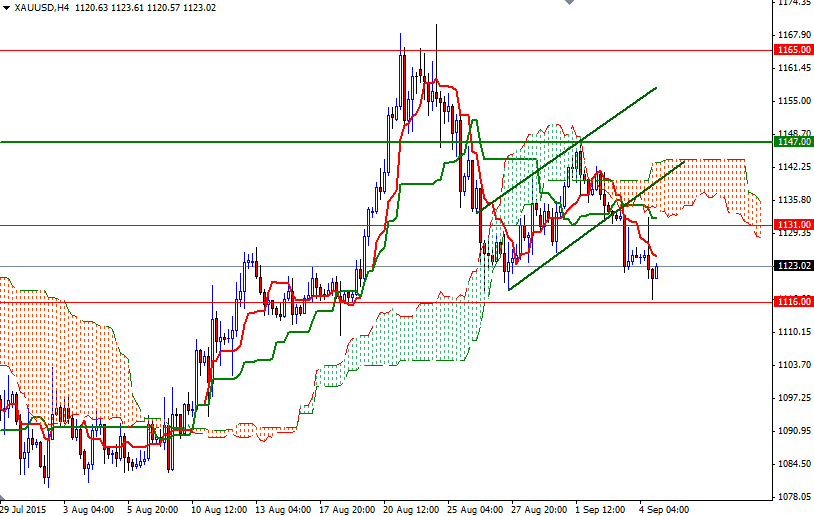

Since last week I have been talking about the resistance zone going all the way up to the 1151 level but this week's trading may be dictated by the borders of the daily Ichimoku clouds (i.e. 1147 and 1108). The weekly and 4-hourly charts are bearish at the moment, with the market trading below the Ichimoku clouds. Additionally, on both charts, we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. If the XAU/USD pair fails to climb and hold above the 1127/5.50 area, the market may continue to grind lower and revisit the support at 1116. Below 1116 look for further downside with 1112 and 1109.70(1108) as targets. On the other hand, if prices can break above 1127/5.50, then we are likely to proceed to the next barrier in the 1135 - 1132.25 zone. The bulls have to push prices above 1135 so that they gather the additional fuel they need to reach 1143.86 - 1141.31.