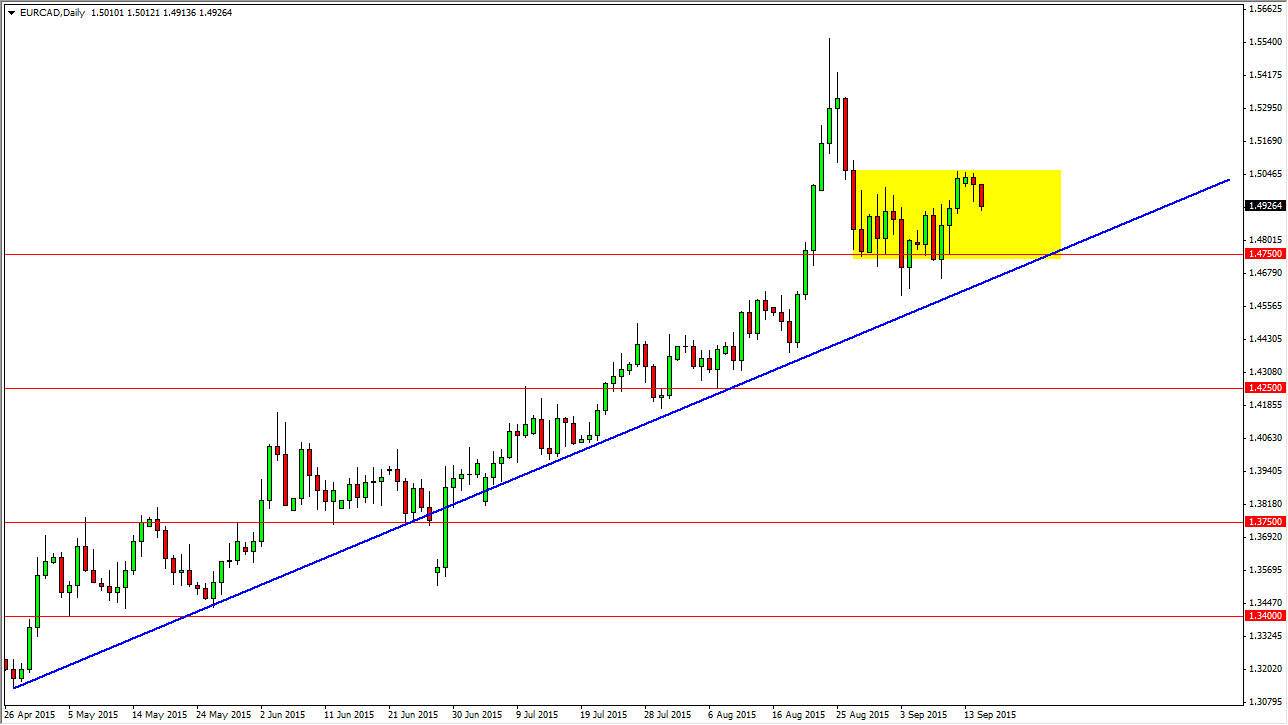

The EUR/CAD pair fell during the course of the session on Tuesday, breaking down below the bottom of the hammer that had formed on Monday. This of course is a very negative sign, but as you can see there is a nice uptrend line that the market has essentially followed for most of the year, and on top of that the 1.4750 level below has been rather supportive. This is an area that we think the market will look for support and, and as a result as we drift lower it’s probably going to find some type of buying pressure near that area. I have a yellow rectangle on the chart, and I believe that is the area where the buyers will get involved. As long as we can stay above the top of the uptrend line, I feel that this market goes higher given enough time.

The effect of the oil markets

Do not forget that the crude Oil Inventory numbers come out during the session today, and that of course will have a massive effect on the value of oil. Consequently, that generally drives the value of the Canadian dollar which of course can show itself in this marketplace. If the pair falls and finds buyers below, a very well could be incongruence with oil prices falling. Most people will trade the USD/CAD pair as a proxy for the oil markets, but lesser-known is the EUR/CAD relationship to the oil markets as well.

Either way, the Canadian dollar will lose value with a price of oil drops. There are other reasons to move this pair obviously, but that is what will more than likely move it today. Somewhere near the 1.4750 level, I would love to get involved to the upside on the first signs of support. Ultimately, the market would then bounced towards the 1.50 level and then possibly even higher than that given enough time.