USD/CHF Signal Update

Last Thursday’s signals expired without being triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be made between 8am and 5pm London time today.

Long Trade 1

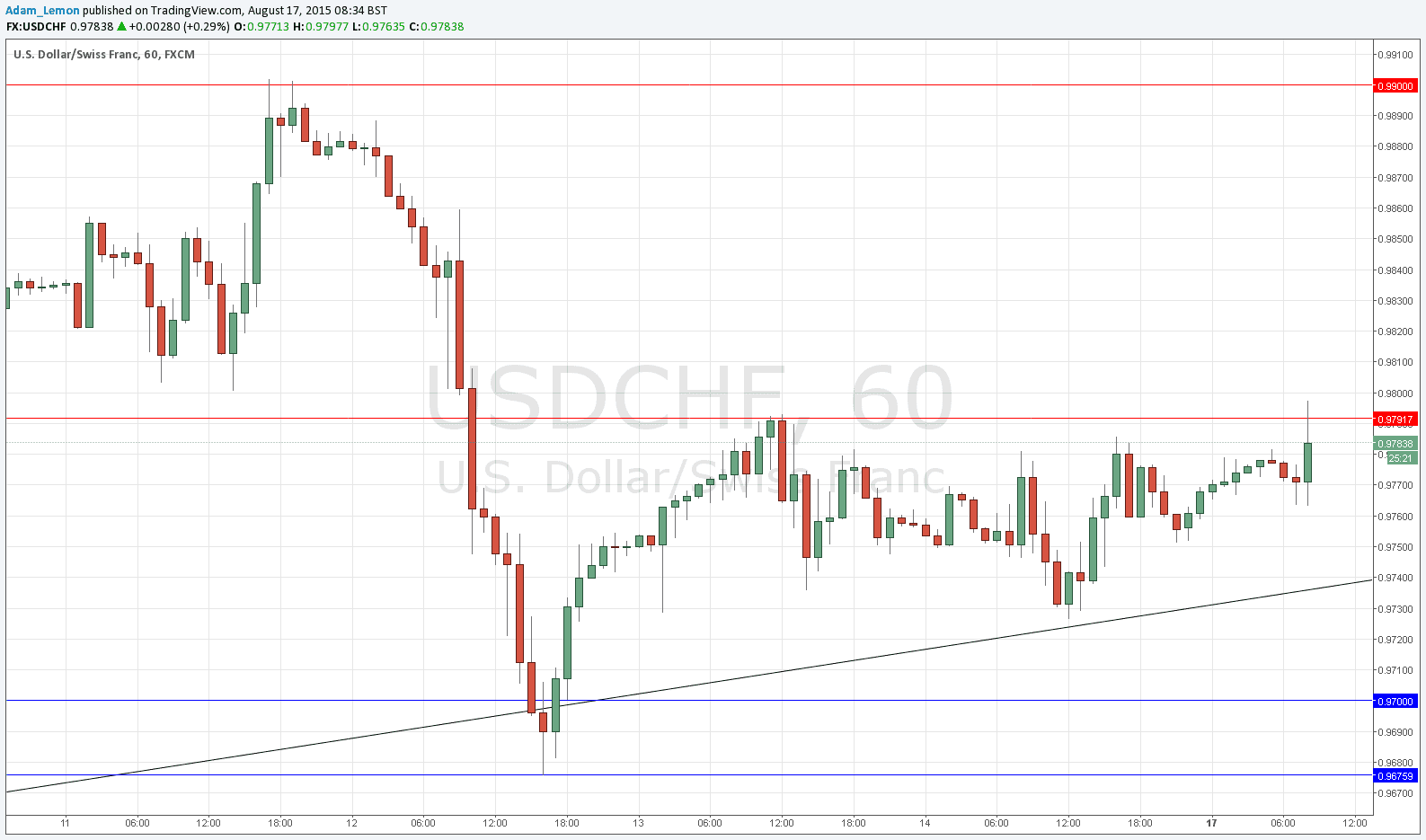

Long entry after bullish price action on the H1 time frame following the next touch of the bullish trend line currently sitting at around 0.9637.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry after bullish price action on the H1 time frame following the next entry into the zone between 0.9700 and 0.9676.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry after bearish price action on the H1 time frame from 0.9792.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

On Friday we had another bullish reversal to the long-term supportive bullish trend line, from which the price had previously bounced bullishly earlier in the week. However these bullish bounces had so far looked a little weak, although this morning the price rose with some strength to hit the next resistance level.

What happens over the next few hours is a test that will indicate the next short-term movement. If the resistance at 0.9792 holds, it could be a good opportunity for a short trade. If the price can confidently break above 0.9800, it is quite likely that it will proceed to 0.9900 at least.

There is nothing due today regarding either the CHF or the USD.