USD/CHF Signal Update

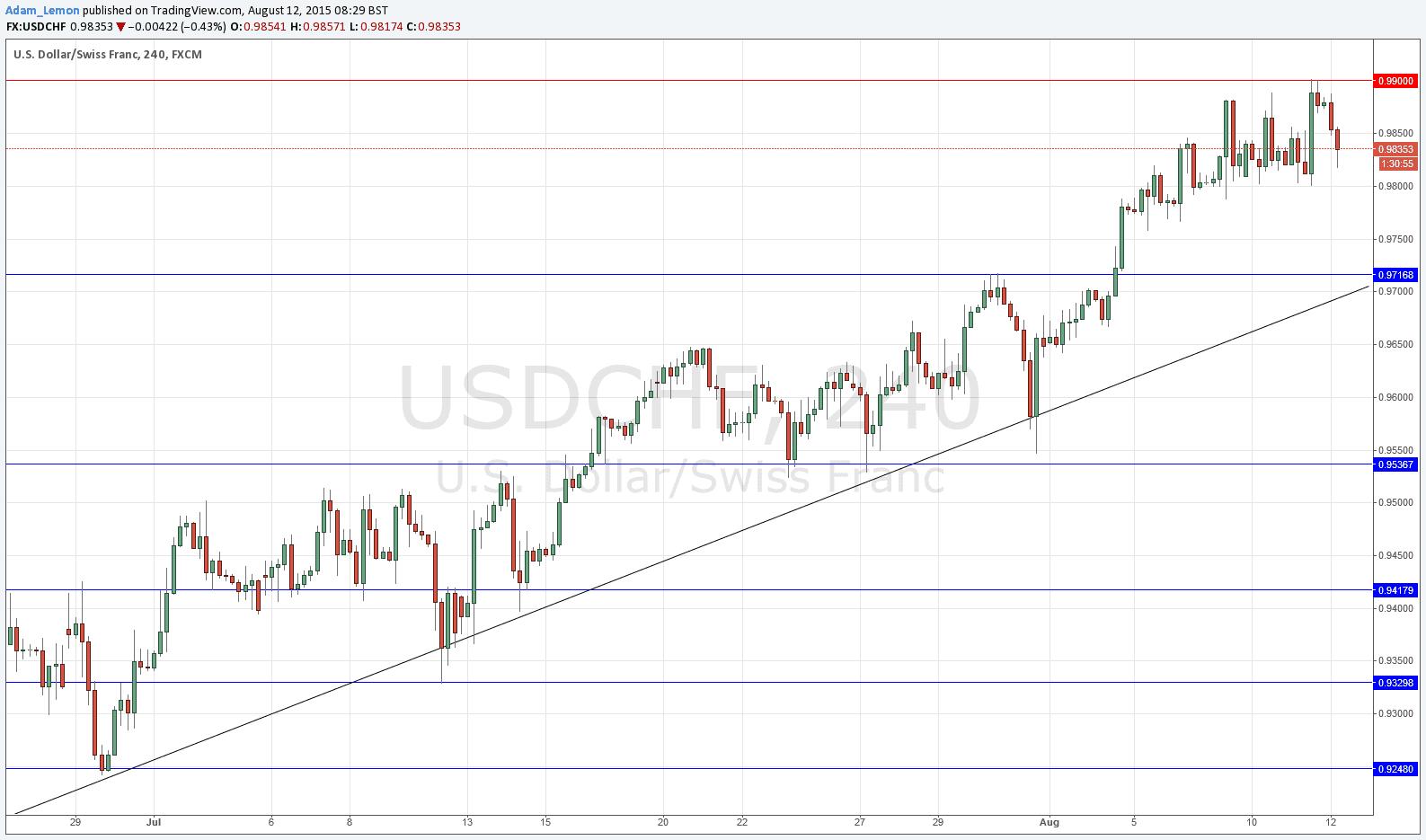

Yesterday’s signals were not triggered as the price did not reach 0.9900 until after London closed, although that level was excellent forecast resistance practically to the pip.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame following the next touch of 0.9717.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry after bullish price action on the H1 time frame following the next touch of the bullish trend line currently sitting at around 0.9700.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 0.9900.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

My forecast yesterday was completely right: resistance at 0.9900 and an overdue pull back. We have had both over the past 24 hours. The question is what will happen next. All the key levels are there. We may either just chop around in the area at 0.9800, or perhaps finally get a deeper pull back to the trend line. When the USD is strong it lately likes to rise most against the CHF, so it will take a deeper pull back in the USD generally to get there, as any central bank input on the CHF side will probably remain lacking. The bullish trend line is now almost confluent with key support at 0.9717 so even at 0.9725 or possibly as high as the psychological level at 0.9750 this pair will probably look like an attractive buy to the market.

There is nothing due today regarding either the CHF or the USD.