USD/CHF Signal Update

Yesterday’s signals expired without being triggered as none of the key levels were hit.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be made before 5pm London time today only.

Long Trade 1

Go long after bullish price action on the H1 time frame following the next touch of 0.9717.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

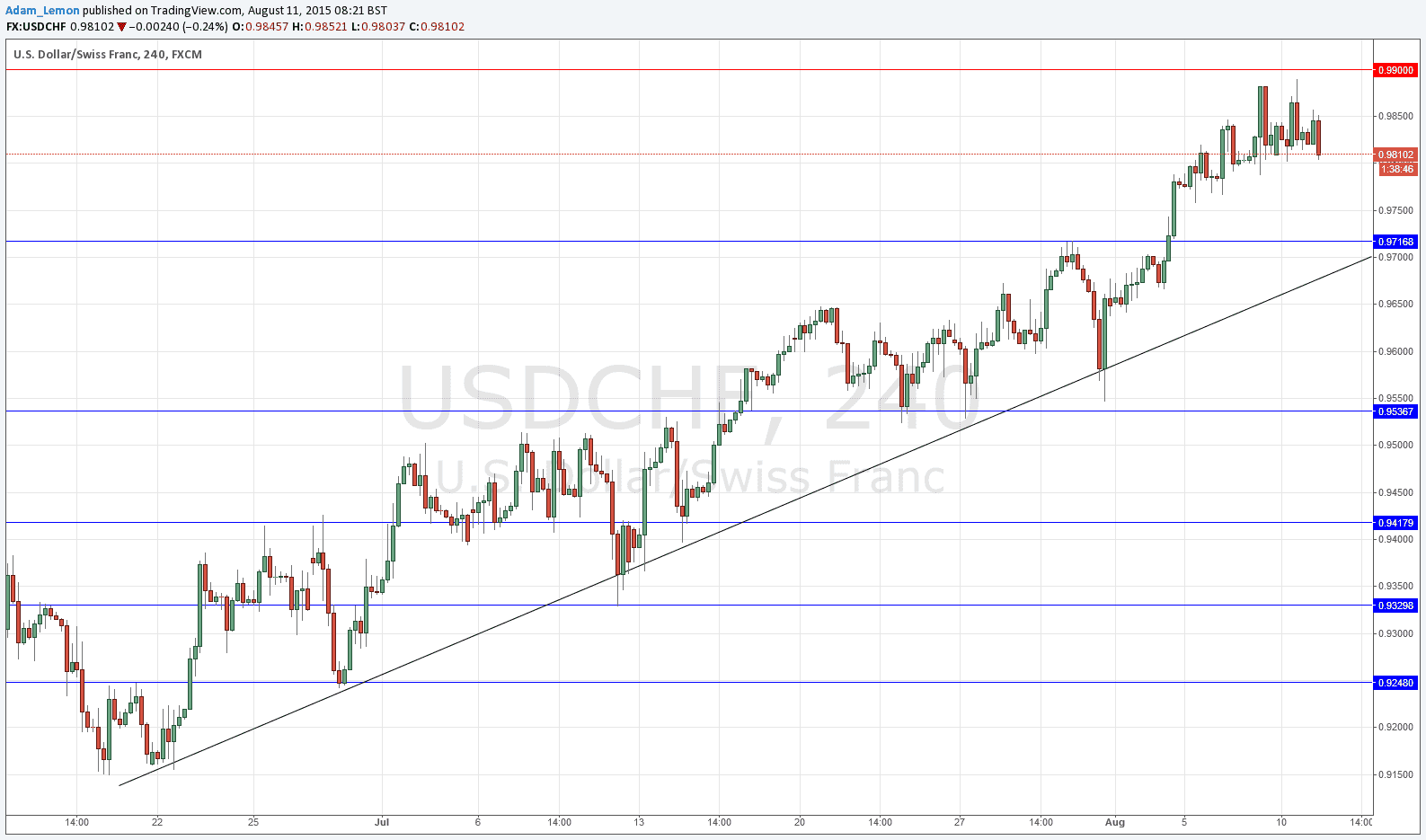

Go long after bullish price action on the H1 time frame following the next touch of the bullish trend line currently sitting at around 0.9690.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 0.9900.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

I wrote yesterday that “the trend is beginning to look somewhat over-extended, as the action has got more volatile and bearish over the past few days, and the price has moved to a location quite far above the trend line. This suggests that the next step is at least some kind of retracement”. This seems to be coming true at the moment, as the chart below shows that although we did make a new high yesterday by a few pips, there is a kind of “topping out” formation going on out there. It does now feel like we will pull back but just how far that will go is debateable.

There will be many stacked positions in this trend, so when key lows are breached there could be a lot of stops being run which would tend to make any fall more violent. Therefore I am not ruling out a pull back to the next good support at 0.9717. If the price reaches this level when it is confluent with the bullish trend line, then so much the better.

There is nothing due today regarding either the CHF or the USD.