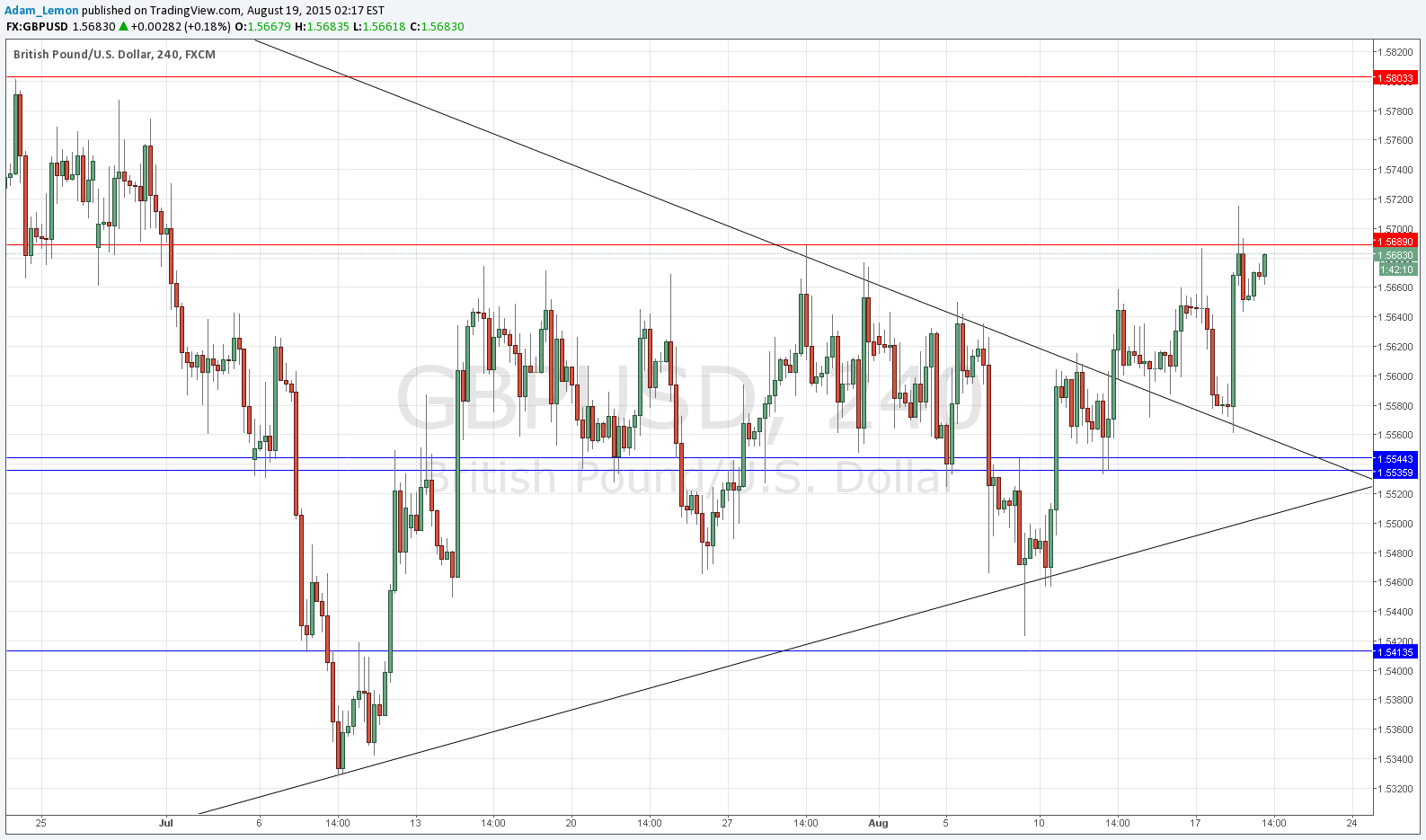

GBP/USD Signals Update

Yesterday’s signals gave an excellent and very profitable long trade off the bullish reversal from the retest of the broken bearish trend line. It is worth taking some profit if you still have the trade open and have no already taken profit at the anticipated resistance zone outlined in yesterday’s signal.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be made before 5pm London time today.

Make sure any open trade is protected before 6:30pm London time.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame off the broken bearish trend line currently sitting at around 1.5555.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5690 and leave the remainder of the position to run.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.5544 and 1.5535.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5690 and leave the remainder of the position to run.

Long Trade 3

Go long following a bullish price action reversal on the H1 time frame off the bullish trend line currently sitting at around 1.5510.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5635 and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5803.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 1.5710 and leave the remainder of the position to run.

GBP/USD Analysis

Yesterday the price behaved very technically predictable, falling back down to the trend line at the London open before reversing bullishly, then really taking off when the GBP was supported by the CPI news release. The price rose quickly to the anticipated resistance, breaking the zone slightly but then stalling. There is still resistance at around 1.5689 but I do not set much store by it. The next resistance level of 1.5803 is in sight. The area between 1.5500 and 1.5550 now has a confluence of three areas of support so it can be expected to be very strongly supportive if tested again.

There is nothing due concerning the GBP. Regarding the USD, there will be a release of CPI data at 1:30pm London time, followed by the FOMC Meeting Minutes at 7pm.