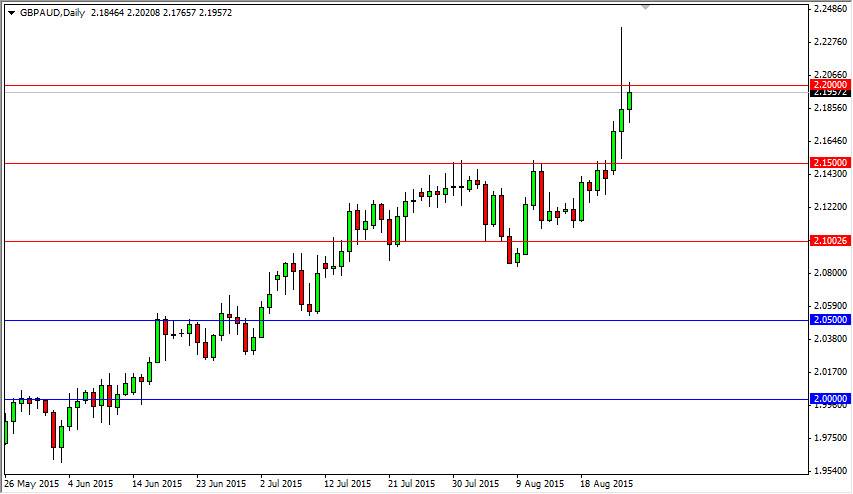

The GBP/AUD pair had a massive move higher on Monday, but it turned back around to form a bit of a shooting star. That of course was a very negative sign but at the end of the day on Tuesday, we find yourselves pressing up against the 2.20 level. That of course is a very positive sign, as the market should eventually get above there and at that point in time I feel that the market continues to go much higher given enough time.

If we can break above the 2.20 level, I think that sooner or later the market will grind its way towards the 2.25 handle, but it may take a while to get up there. After all, the British pound has shown a bit of strength against most currencies, and has at least “held its own” against the US dollar. That of course shows signs of strength, as everything else has been pummeled by the US dollar until the last couple of sessions. On the other hand, this market features the Australian dollar as well, and that is one of the softest currencies out there.

Gold isn’t helping

Although people typically think of the AUD/USD pair as the proxy for gold, you have to keep in mind that the Australian dollar itself is highly influenced by it. With this, I feel that this market continues to go much higher as gold continues to sink. After all, we had a strong rally in gold for a few sessions, only to see it sell off again during Tuesday. That just simply removes yet another reason for the Australian dollar to strengthen, and therefore I feel this market has been given the “greenlight” to finally break out to the upside. I have to wonder how many resistive sell orders above the 2.20 level were blown out on Monday, and now I feel that it’s only a matter of time before we jump over that region. I believe that the 2.15 level is essentially the “floor” in the market.