EUR/USD Signal Update

Yesterday’s signals were not triggered as the price did not hit either of the key levels.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be taken between 8am and 5pm London time today.

Long Trade 1

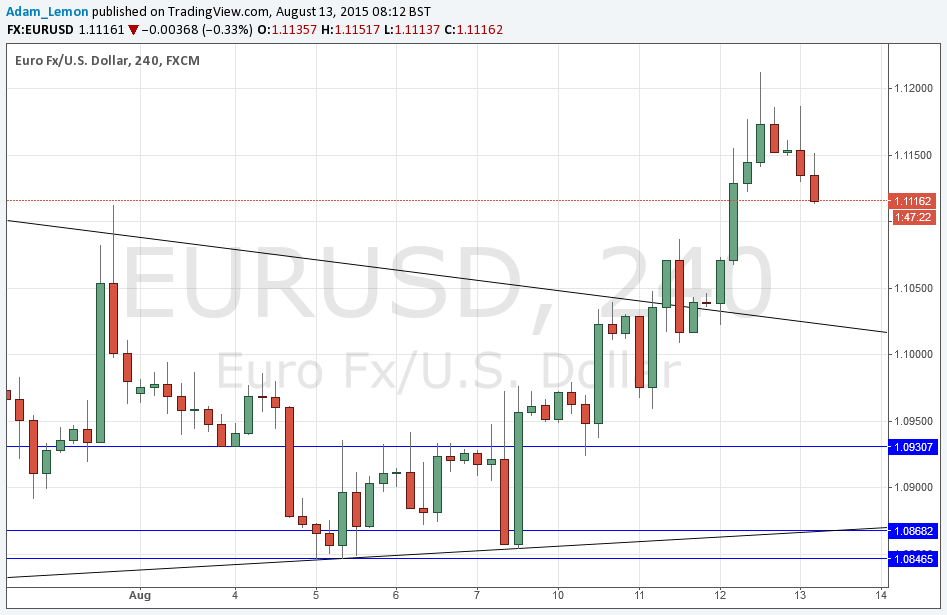

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the broken bearish trend line currently sitting at around 1.1020.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0930.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

I wrote yesterday “I do not see any good resistance before 1.1292 and there is plenty of bullish momentum, so the line of least resistance looks clearly upwards.” This was a good forecast of what was to happen as we had a strong upwards move. Of course after such a strong move, it is not a surprise the USD then comes back overnight. It is hard to say what will happen next as we are quite far from either good support at the trend line or the next solid resistance at 1.1292, so we may chop around. There is probably resistance before 1.1292, most notably at 1.1250, but it looks unpredictable.

There is nothing due today regarding the EUR. Concerning the USD, there will be releases of Retail Sales and Unemployment Claims data at 1:30pm London time.