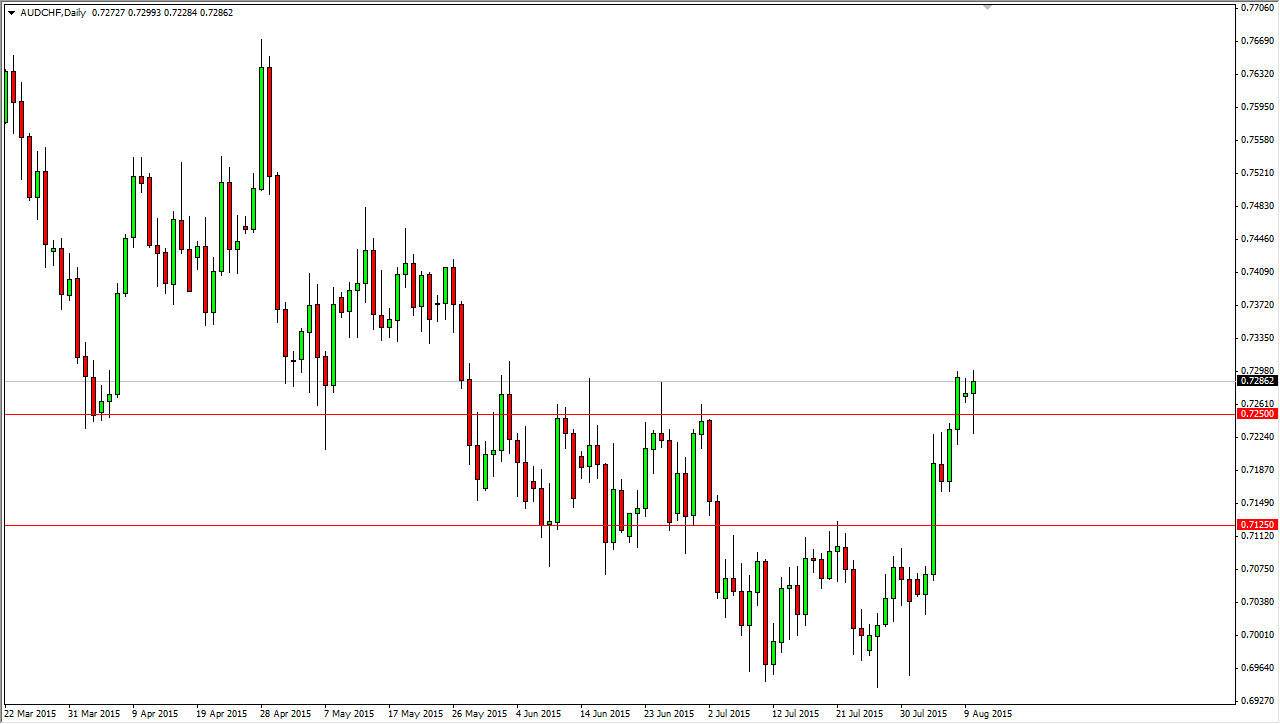

The AUD/CHF pair initially fell during the course of the day on Monday, but found enough support at the 0.7250 region to turn things back around and form a nice-looking hammer. The hammer of course suggests that we are going to go higher, and as a result I am a buyer on a break above the top of the hammer as it is a classic signal to start going long.

I don’t like the Australian dollar in general, but I do recognize that this pair is a little bit of an outlier. After all, the Swiss National Bank is working against the value of the Swiss franc in general, and although I do not believe that they are specifically buying Australian dollars, the truth of the matter is that sooner or later there is a bit of a “knock on effect” in all of the XXX/CHF pairs.

Buying pullbacks

I believe that this market should continue to go higher, perhaps heading to the 0.75 level given enough time, and perhaps even higher than that. This won’t necessarily be an explosive move higher, because quite frankly I do not see the Australian dollar strengthening that much. Any pullback at this point in time should be thought of as “value”, or perhaps more importantly the Australian dollar being “overbought.”

I think that the area between the 0.7250 level and the 0.7100 level is a massive support range, and that should of course continue to attract buyers. We have in fact formed a nice rounded bottom, and as a result I think it’s only a matter of time before we do go higher. I do not think that it will be easy that as I said, but this is one of the few Forex pairs as you can trade anymore that has a reasonable swap at the end of the day. Think of this more or less as an investment, and not a short-term trade.