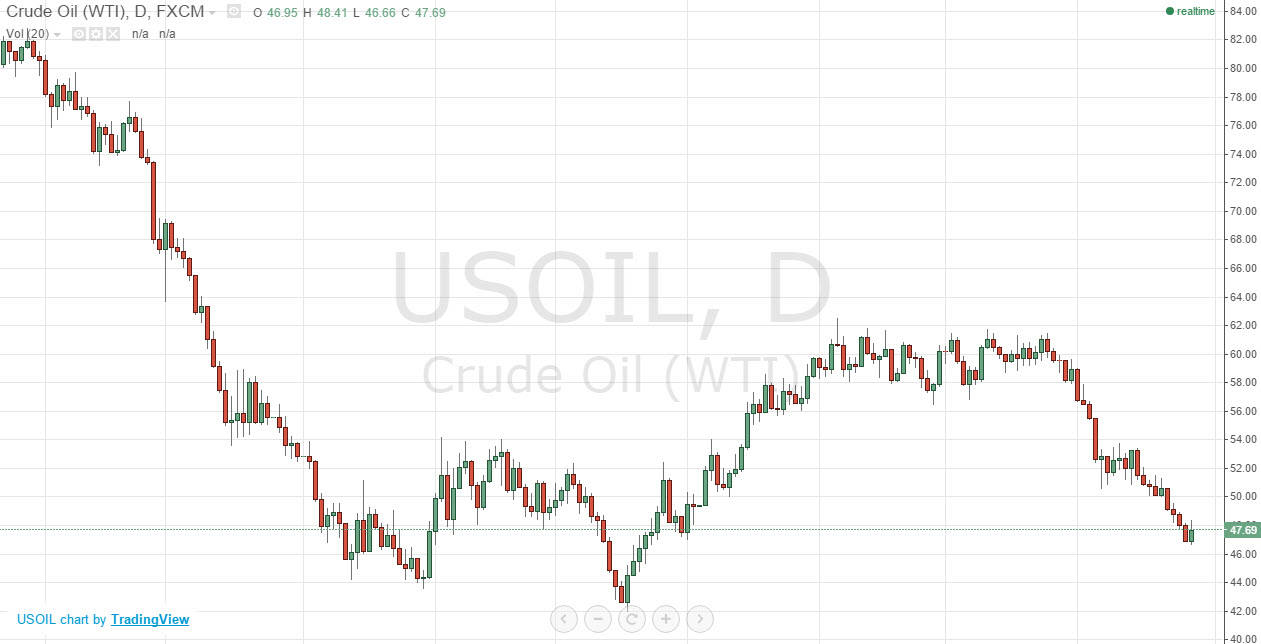

During the session on Tuesday, we saw the WTI Crude Oil markets rise a bit, as the $47 level offered some support in this embattled market. With this, I suspect that the markets are simply trying to cover shorts before the Crude Oil Inventories number out of America today. This of course can move the markets, as we will see whether or not demand is picking up. This means that a lot of “weak hands” will be getting out as I type this.

The market need to bounce though, as we have sold off so much. The market should eventually find sellers above, as the $50 level above should be massively resistive. The markets will more than likely respect that level as it is a large, round, psychologically significant number. Also, there are a lot of moving pieces in this market at the moment.

Chinese demand

There are going to of course be concerns about whether or not the Chinese will continue to burn through oil at a steady rate, as the demand simply hasn’t been that strong. Exports are suffering, and the markets (stock) in China have been horrendous. This of course has a lot of people shunning risk at the moment, although it should be said that the Tuesday session was a bit of a rebound for risk. The stock markets in America showed that they are still bullish over the long-term, so this could be a sign that risk appetite isn’t exactly dead. However, I don’t see enough support off of this level to start buying. I think that the markets are going to rally, and then find sellers above between here and $50 to finally break down to the $45 level, where I expect to see more buying pressure.

The market should continue to offer short-term moves basically, so it is possible that there might be several opportunities to sell in the next few sessions as this market is certainly bearish to say the least.