USD/JPY Signal Update

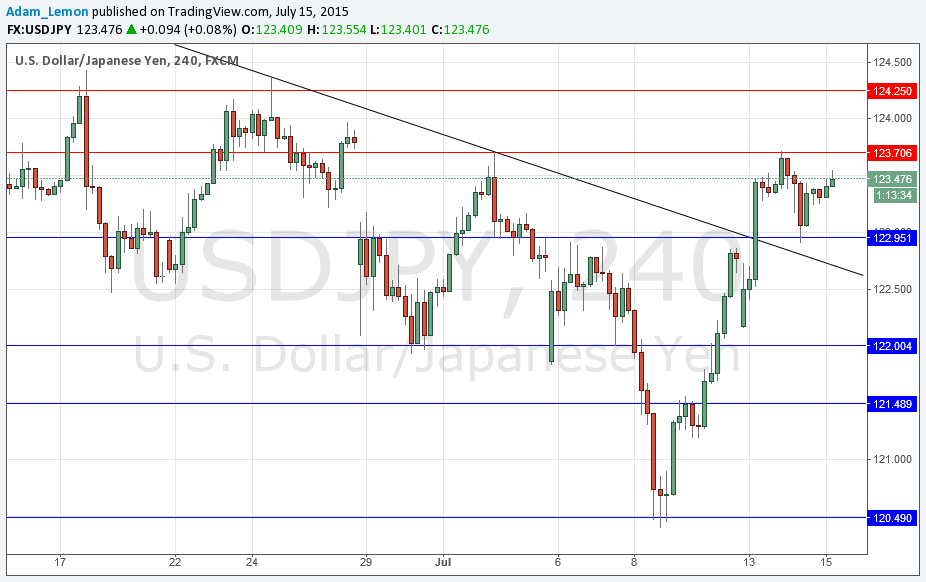

Yesterday’s signals produced a profitable trade following the bounce off the support level at 122.95 that would still be open and, even better, protected. This is probably worth holding on to for the time being.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 122.95.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of the broken bearish trend line currently sitting at around 122.70.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 123.71.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The pair continued to look bullish as it found support at the key level of 122.95. However its true test will be whether it manages to clear the probable resistance at 123.71. A bearish bounce off that level following disappointment for the USD after Yellen’s remarks could be a perfect short trade. Alternatively, bullish USD sentiment coupled with a breakout past 123.71 could see this pair take off again.

There is nothing further due today regarding the JPY. Concerning the USD, there will be a release of PPI data at 1:30pm London time followed by the Fed Chair’s testimony before Congress at 3pm, which is likely to be very important.