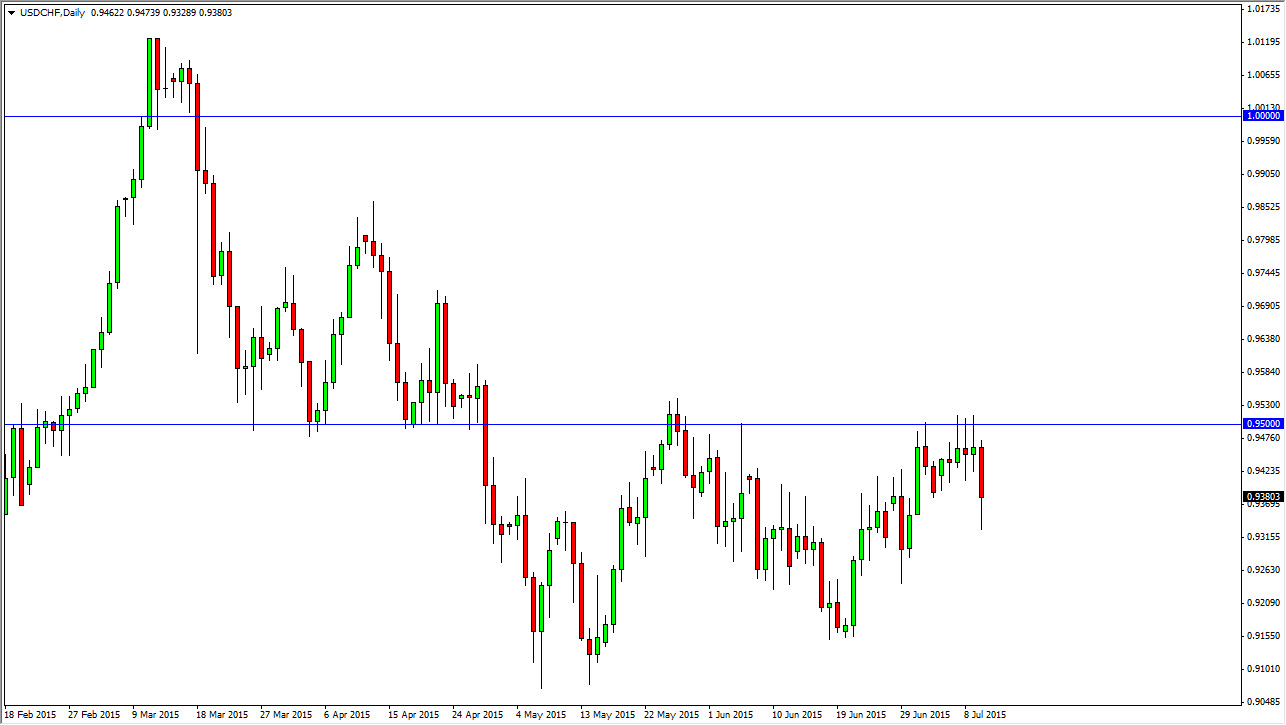

The USD/CHF pair fell rather hard during the course of the session on Friday, but found enough support near the 0.9350 level to turn things back around and bounce slightly. The market has been in a fairly tight consolidation area lately, and as a result it’s not a surprise at all if we tried to head back towards the 0.95 level. This is an area that has been massively resistive, and as a result it’s going to take quite a bit of effort to break back above there. However, I do recognize that if we get above the 0.96 level, this market continues to go much higher.

Ultimately, if we do that, I would anticipate that this market would head to the 0.98 level. However, you have to keep in mind that this market is the inverse of the EUR/USD pair, and as a result I believe that the market will more than likely fall rather than go higher due to the fact that the EUR/USD pair should continue to go higher based upon a potential Greek solution.

Larger consolidation

The larger consolidation should send this market down to the 0.9150 level, which is the bottom of the overall consolidation that we have seen for several months now. I believe that summertime trading is going to be a bit difficult though, and as a result I don’t know if we can break out of this area. With that being the case, it’s likely that this pair will continue to be volatile, but you should be okay if you stick to short-term charts and of course small positions.

Ultimately, the Greek debt crisis will continue to drive what happens in the Euro, which of course is a major driver in this pair. I think that there will be continued volatility, but nonetheless there will be short-term trading opportunities to the downside possibly. We need to break down below the bottom of the range for the session on Friday in order to start selling, or perhaps some type of short-term rally that fails could be used as an entry point. Again though, if we break above the 0.96 level, that changes everything.