USD/CHF Signal Update

There are no outstanding signals.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time.

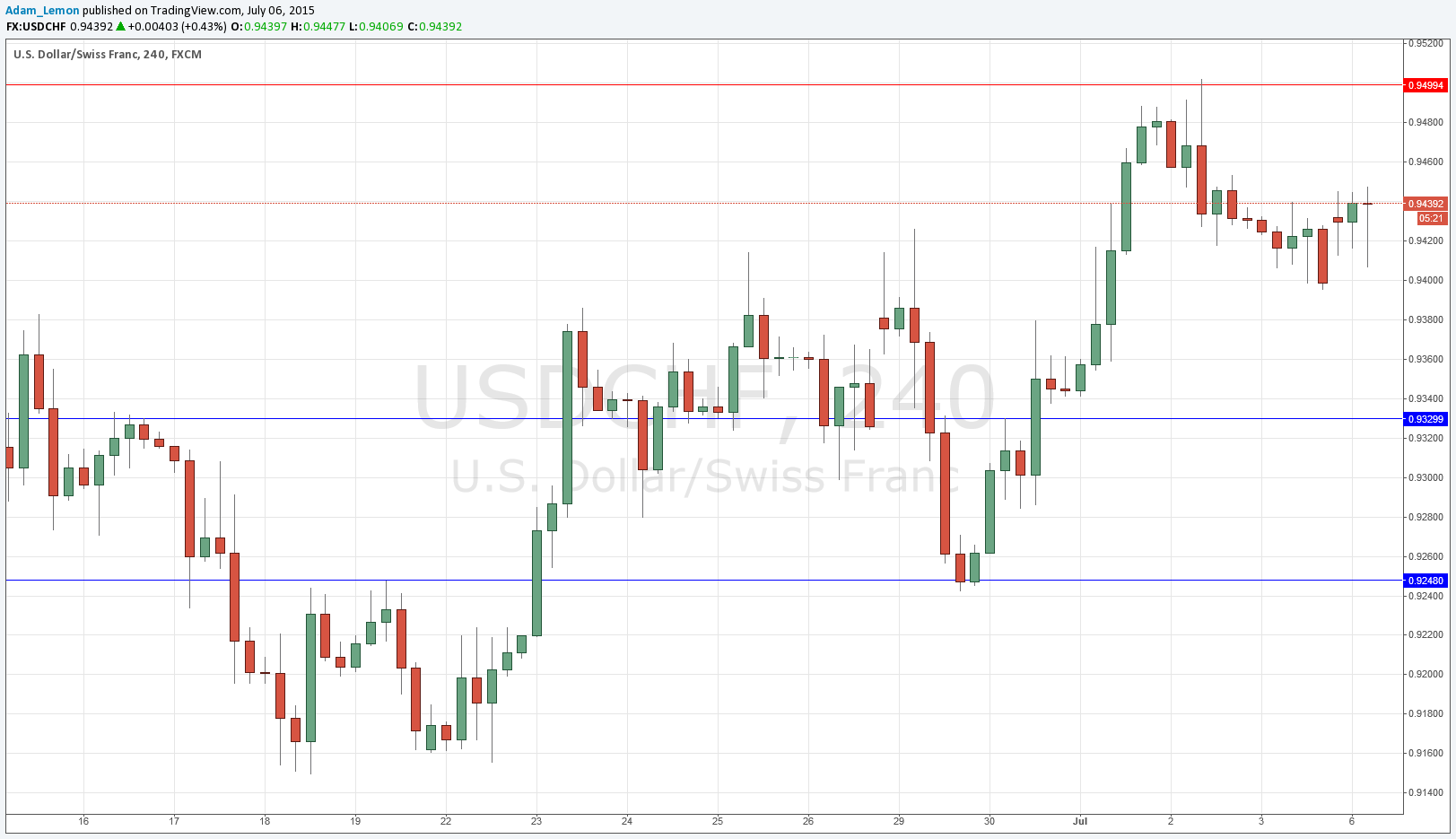

Short Trade 1

- Short entry after bearish price action on the H1 time frame following the next touch of 0.9500.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

- Long entry after bullish price action on the H1 time frame following the next touch of 0.9330.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

This pair tends to range, and at the present moment is still caught within a long-term consolidation process stemming from January’s huge price shock. Think of the CHF like a tuning fork that received a massive blow. It is still vibrating backwards and forwards, albeit with decreasing intensity.

We are currently ranging between roughly 0.9500 and 0.9250. This is a wide range but either level could give a good low risk, high reward trade opportunity.

At 3pm London time there will be a release of U.S. ISM Non-Manufacturing PMI data. There is nothing due today regarding the CHF.