NZD/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

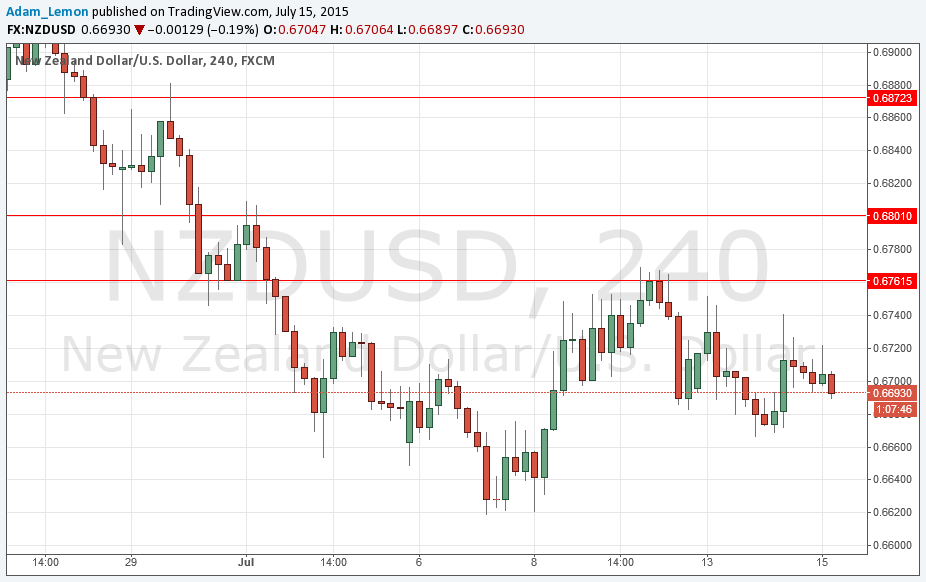

Short Trade 1

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.6762.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.6800.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

If the USD strengthens later today, this could be a great currency pair to be short of, as it looks the most bearish and is actually gently falling and has been for several hours. There will be USD data first, followed by New Zealand data. If both push the pair down there could be a significant move for a short trade.

During the forthcoming Asian session the GDT Price Index will be released. This is crucial data for the NZD. There will also be a release of New Zealand CPI data at 11:45pm London time. Concerning the USD, there will be a release of PPI data at 1:30pm followed by the Fed Chair’s testimony before Congress at 3pm, which is likely to be very important.