Gold prices ended Tuesday nearly unchanged as investors remained cautious ahead of the Federal Open Market Committee announcement today. The Fed could use the meeting to tweak the language of its statement to prepare the markets for a September rate hike. Just a couple weeks ago Yellen reiterated the Fed remains on track to begin the normalization process this year, with employment expected to improve steadily and turmoil abroad unlikely to throw the economy off track.

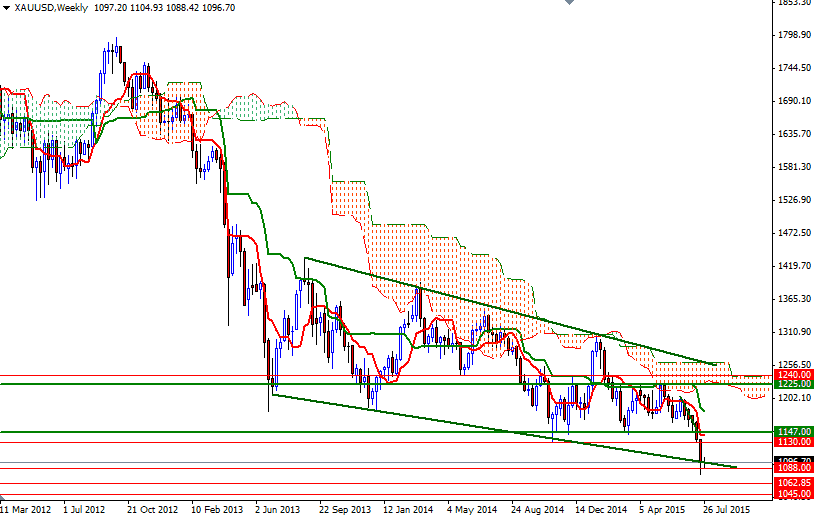

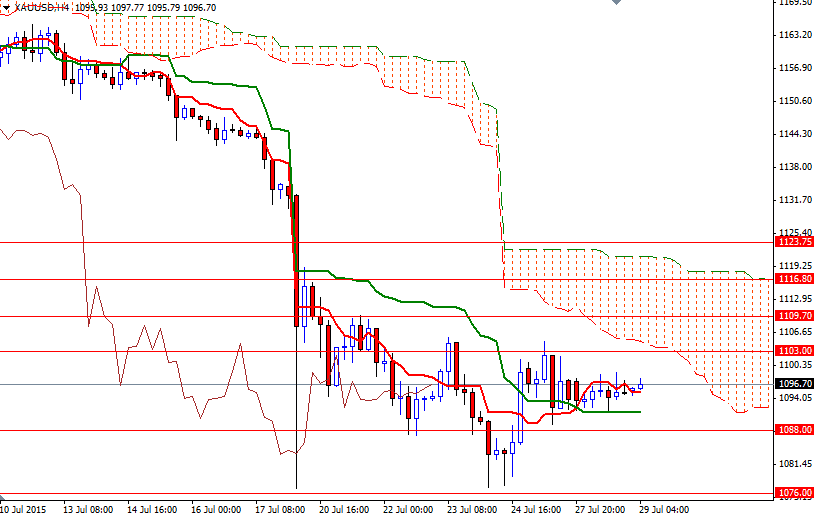

The XAU/USD pair has really gone nowhere over the past few days. The trading action is getting tight and as you can see on the 4-hour chart the candlesticks are indicating a real lack of momentum. From a long term perspective, trading below the Ichimoku clouds on the weekly and daily time frames indicates the bulls are not strong enough to dominate the market. Long-term outlook will remain negative until the market breaks out of the descending channel, which prices have been running in since July 2013, and anchors somewhere above the weekly cloud.

However, a short term upswing is quite possible depending on the Fed's stance. XAU/USD is being supported by the Ichimoku clouds on the hourly and 30-m charts. We also have bullish Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) crosses. To the upside, the bulls will have to push through 1105/3 area in order to gain enough traction to tackle the next barrier standing on the way at 1109.70. A daily close above this level would suggest that the market will be aiming for 1116.80 afterwards. On the other hand, if the greenback gets a boost and prices fall through the 1088/6 support, we might head back to the 1076/1 area.