Gold prices settled at $1167.76 per ounce, falling 1.44% over the course of the week, as strength in the U.S. dollar outweighed uncertainty over Greece's future in the euro zone. The XAU/USD pair tested the $1157 support level on Thursday but trimmed a portion of losses and climbed back above the 1166 level after the non-farm payrolls report fell short of market expectations. At first glance, the U.S. numbers are not bad, though downward revisions to the prior two months tempered expectations for a September interest rate hike.

Gold is often seen as a safe, tangible commodity in times of turbulence but it seems the Greek crisis hasn't freaked out the markets. There has been no sign so far that the crisis is spreading to other vulnerable countries in the block, such as Portugal and Spain, but of course there is no guarantee the stability will last. Greece votes today (Sunday) on whether to accept more austerity in exchange for international aid.

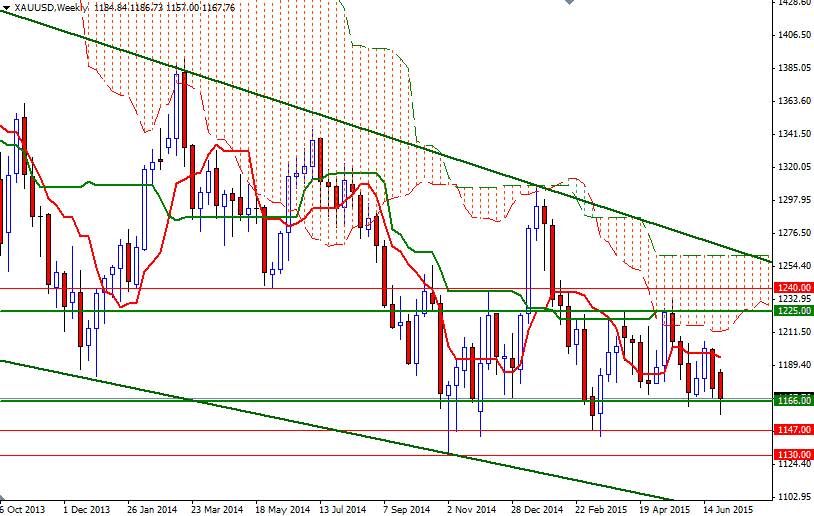

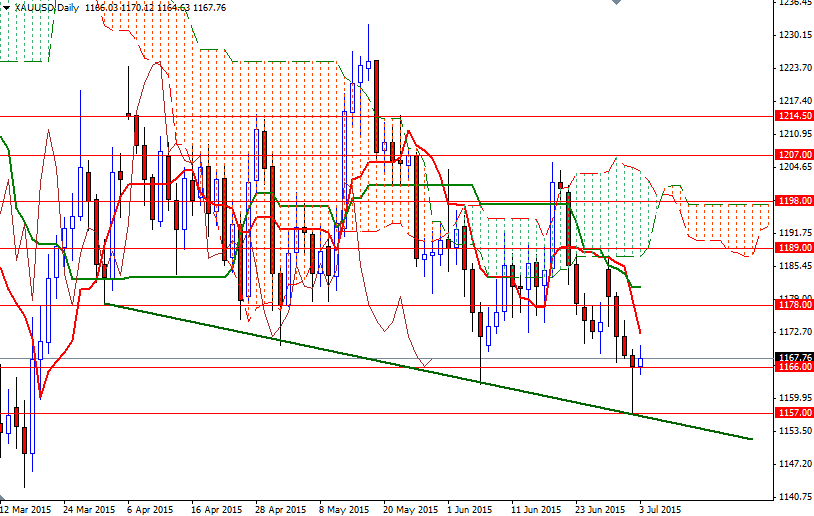

The XAU/USD pair, pressured by the weekly Ichimoku clouds, has been following a descending channel since mid-2013. Therefore, until the market climbs above the weekly cloud and breaks out of this channel, the upside potential in the long term is likely to be limited. Negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) lines also support this theory. On the other hand, the shorter term descending trend-line (daily chart) and the market's reluctance to close below the 1166 support level are something to pay attention to. If buyers hold prices above 1166 and pass through 1172.52, they could have a chance to tackle the 1179/8 resistance level. Penetrating this barrier could increase the prospect of a new attempt to revisit the 1189/7 area. To the downside, initial support is at 1166, followed by 1163.50. If XAU/USD drops below the 1163.50 support, I think the 1157 level will be tested again. Closing below 1157 would indicate that sellers will be aiming for the 1147 level next.