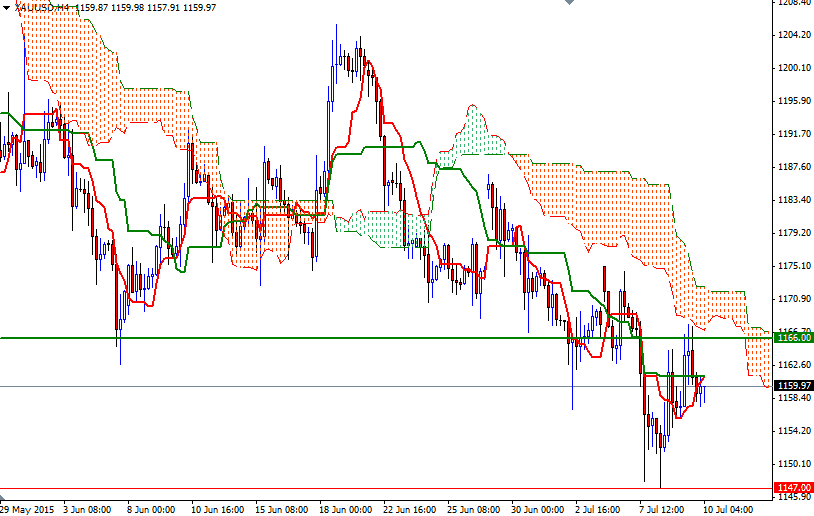

Gold market initially rallied during yesterday's session but pared gains as sellers stepped in around the key resistance level of 1168/6. The XAU/USD pair traded as high as $1167.72 an ounce after the U.S. Labor Department reported that the number of first-time applicants for jobless benefits increased 15K to 297K but a recovery in Chinese stocks and signs that Greece was making some progress in its efforts to stay in the euro zone capped gains.

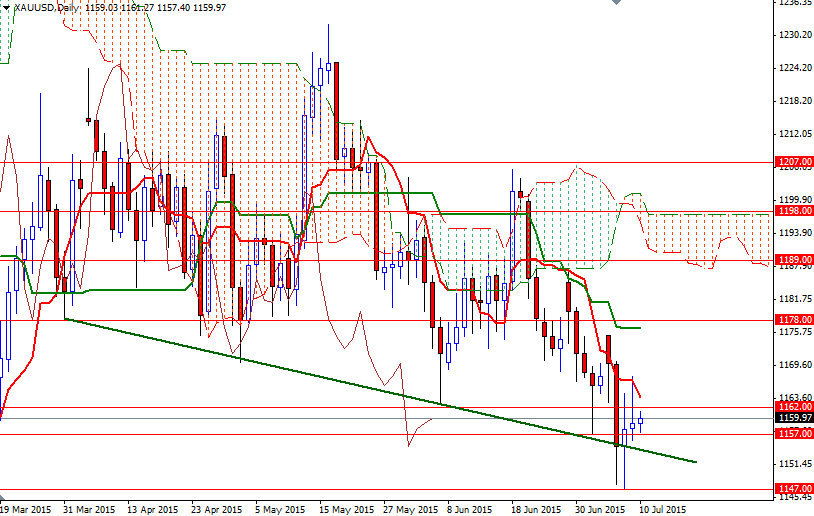

In my previous analysis, I had described the 1147 level a logical area at which a bullish reversal might occur. Since this support still remains intact, there won't be much room to the downside. The short-term charts are slightly bullish at the moment, so I will be monitoring the 1163.76/1162 and 1158.28/1157 zones. Beyond 1163.76, the are a bunch of resistance levels clustering in the 1172 - 1166 region. Only a daily close above 1172 could provide the bulls the momentum they need to march towards the 1180 - 1178 resistance.

However, keep in mind that the long-term charts remain negative, with the market trading below the Ichimoku clouds on the weekly and daily time frames - plus prices have been following a descending channel dating back to July 2013. I think the bears will need to drag the market below the 1157 level in order to tackle the next support located at 1152. If this support gives way, all attention will turn to 1147. Falling through this critical level would trigger extra selling and increase the possibility of a fresh attempt to visit the November 7 low of 1130.28.