Gold prices settled higher on Friday, extending their gains to a third straight session, as concerns about the developments in China and Greece increased desire for safe haven diversification. The precious metal trimmed earlier gains after U.S. Federal Reserve Chair Janet Yellen said "I expect it will be appropriate at some point later this year to take the first step to raise the federal funds rate and thus begin normalizing monetary policy". However, she added a note of caution, saying that "But I want to emphasize that the course of the economy and inflation remains highly uncertain, and unanticipated developments could delay or accelerate this first step".

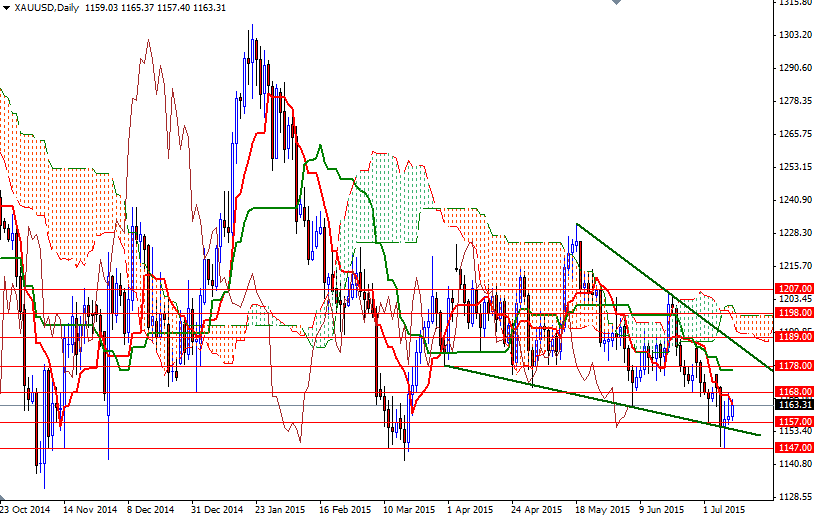

Gold rebounded nearly 1.5% since the market found support at 1147 -which was tested on Wednesday- but in order to confirm a further push up there are some tough barriers for the bulls to pass through. The Ichimoku cloud on the 4-hour time frame is right on top of us and it occupies the area between roughly the 1172 and 1168 levels. If prices can anchor somewhere above 1172, it would be a sign of a bullish recovery. In that case, we could see the XAU/USD pair heading towards the bottom of the daily cloud, sitting at 1189. On its way up, resistance can be found at 1178 and 1184 (the upper line of the wedge).

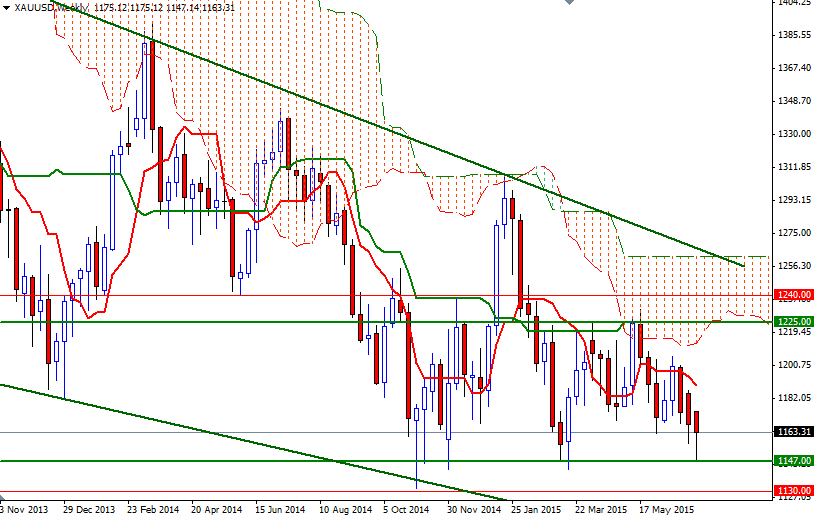

Although we have to assume that the critical 1147 level will hold in the short-term, it is difficult to get too bullish on gold in the long term. This is simply because the market is trading beneath the Ichimoku cloud on the weekly time frame and still following a descending channel originating in July 2013. A break below the 1130 support would make me think that the market will have a tendency to retreat towards the lower border of the ascending channel, as it might lead to another sell-off.