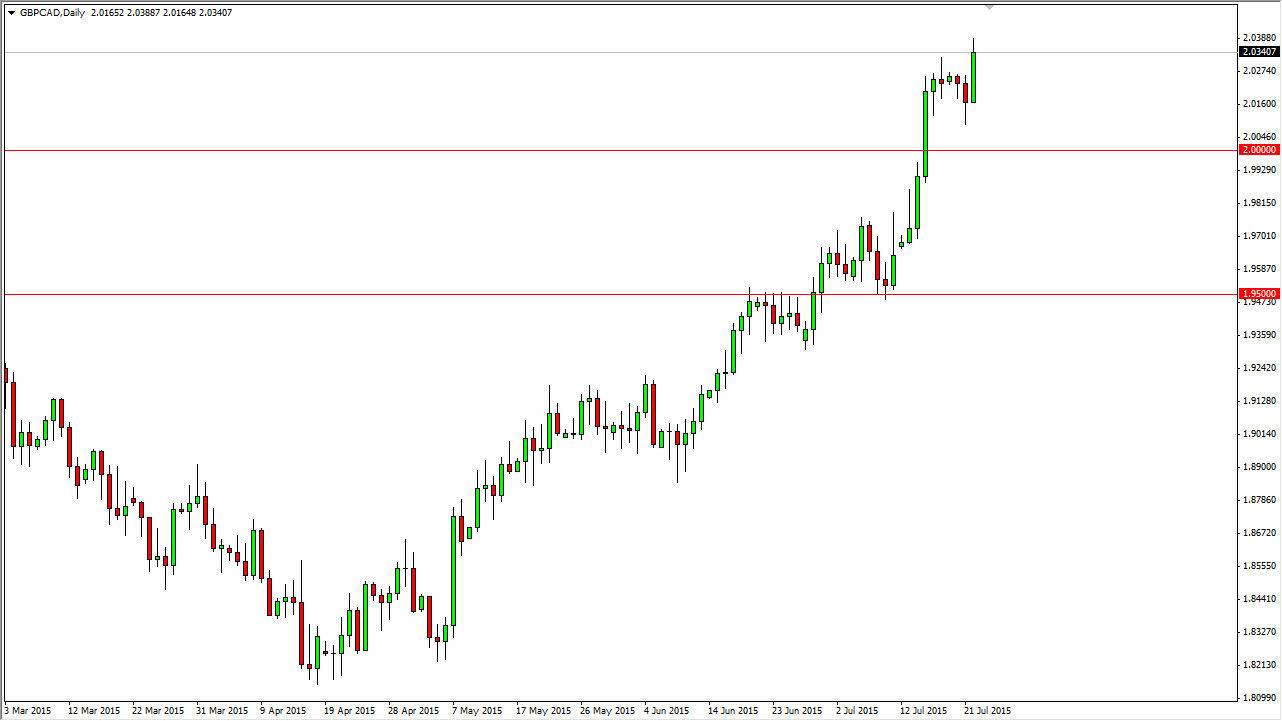

The GBP/CAD pair found quite a bit of bullish pressure to the upside during the day on Wednesday, as we made a fresh, new high. Breaking above the 2.0350 level made a lot of sense as the oil markets fell, and although there is a slight component of oil to the British pound, Forex traders tend to pay much more attention to the Canadian dollar when it comes to this particular commodity. With that, I believe that the markets will ultimately grind much higher, possibly heading to the 2.05 level which is the next large, round, psychologically significant numbers far as I can see.

I think pullbacks continue to offer buying opportunities as the British pound of course has shown some strength recently. I also believe that the “floor” in this market is the 2.00 level, as it is about as big of a “round number” as you can get. I believe that a lot of big-money traders are down there waiting to see if this market pulls back. In other words, there should be a massive amount of support in that region.

Continued bullishness

I really don’t see anything at this moment in time that should change the bullishness of this market, as the British economy is doing much better than the Canadian economy. On top of that, oil markets don’t exactly look like they are ready to rally at this point in time, so I believe it’s only a matter of time before the markets will eventually continue to punish the Canadian dollar over the course of the next several sessions. I also look at pullbacks as essential “value” in the British pound.

It is not until we see the oil markets break higher, and perhaps above the $60 level in the WTI Crude Oil market that I would feel comfortable selling this market, but only after it reaches below the 2.00 handle. In other words, it is much easier for me to go long of this market as opposed to sell it.