EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered before 5pm London time today.

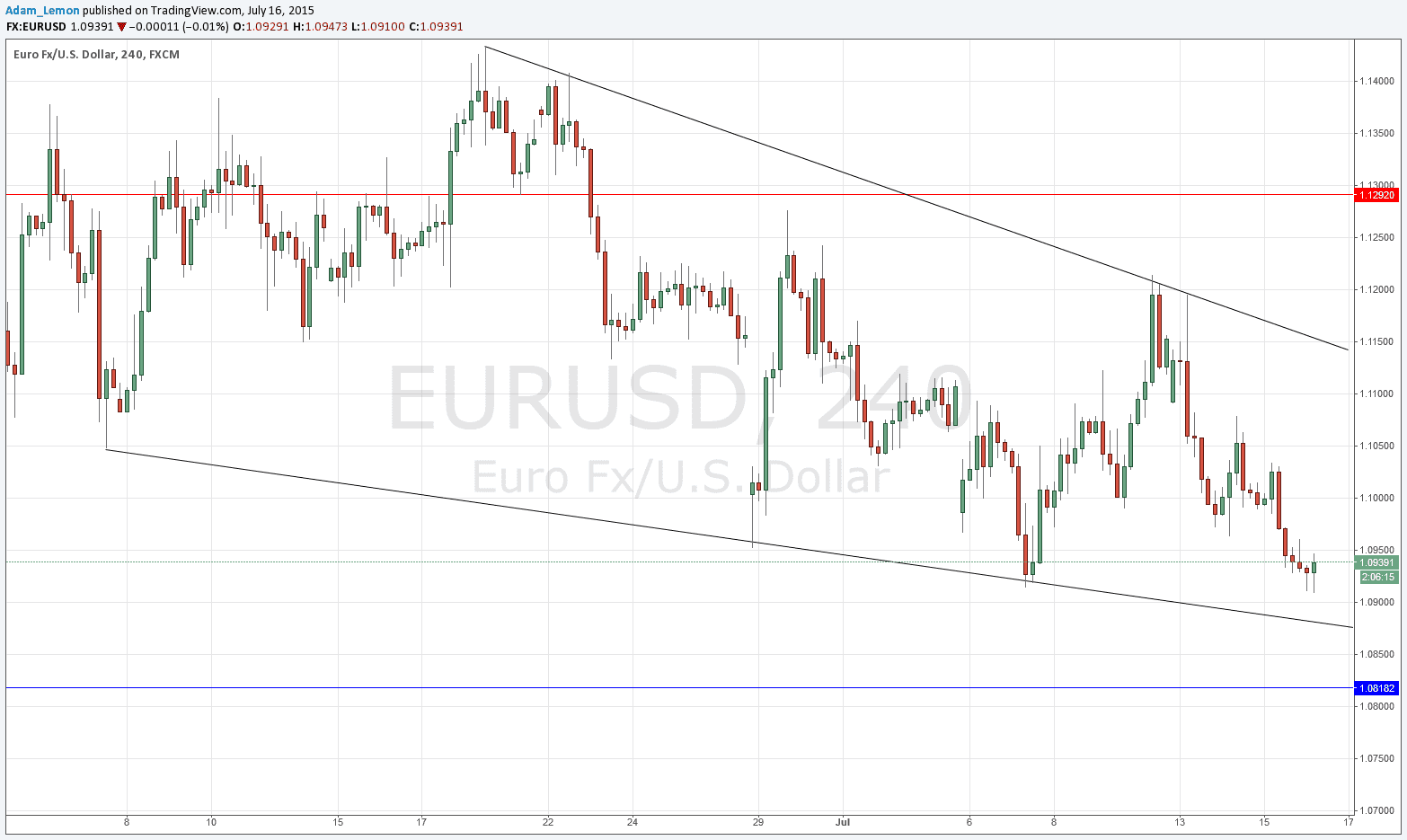

Short Trade 1

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of the bearish trend line currently sitting at around 1.1150.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the lower trend line currently sitting just above 1.0880.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

The USD strengthened yesterday during the New York session following Janet Yellen’s comments, and although the EUR is not one of the weakest currencies, the effects of that were felt here too with a new low close the 1.0900 figure being reached within the last few hours.

Technically, there has been a significant development with the break below the first of the potentially supportive trend lines, which I have now therefore erased from my chart below. Therefore we are in a confirmed bearish channel now.

Action will probably be relatively sticky for a while, but it would not surprise me if the downwards trend really resumed in earnest starting in late August or early September.

Regarding the EUR, at 12:45pm London time the ECB will announce the Minimum Bid Rate, and this will be followed by the customary Press Conference beginning at 1:30pm. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm followed by the Fed Chair’s testimony before Congress and the Philly Fed Manufacturing Index at 3pm.