USD/JPY Signal Update

Yesterday’s signals were not triggered as there was no bullish price action when the price reached 124.33.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

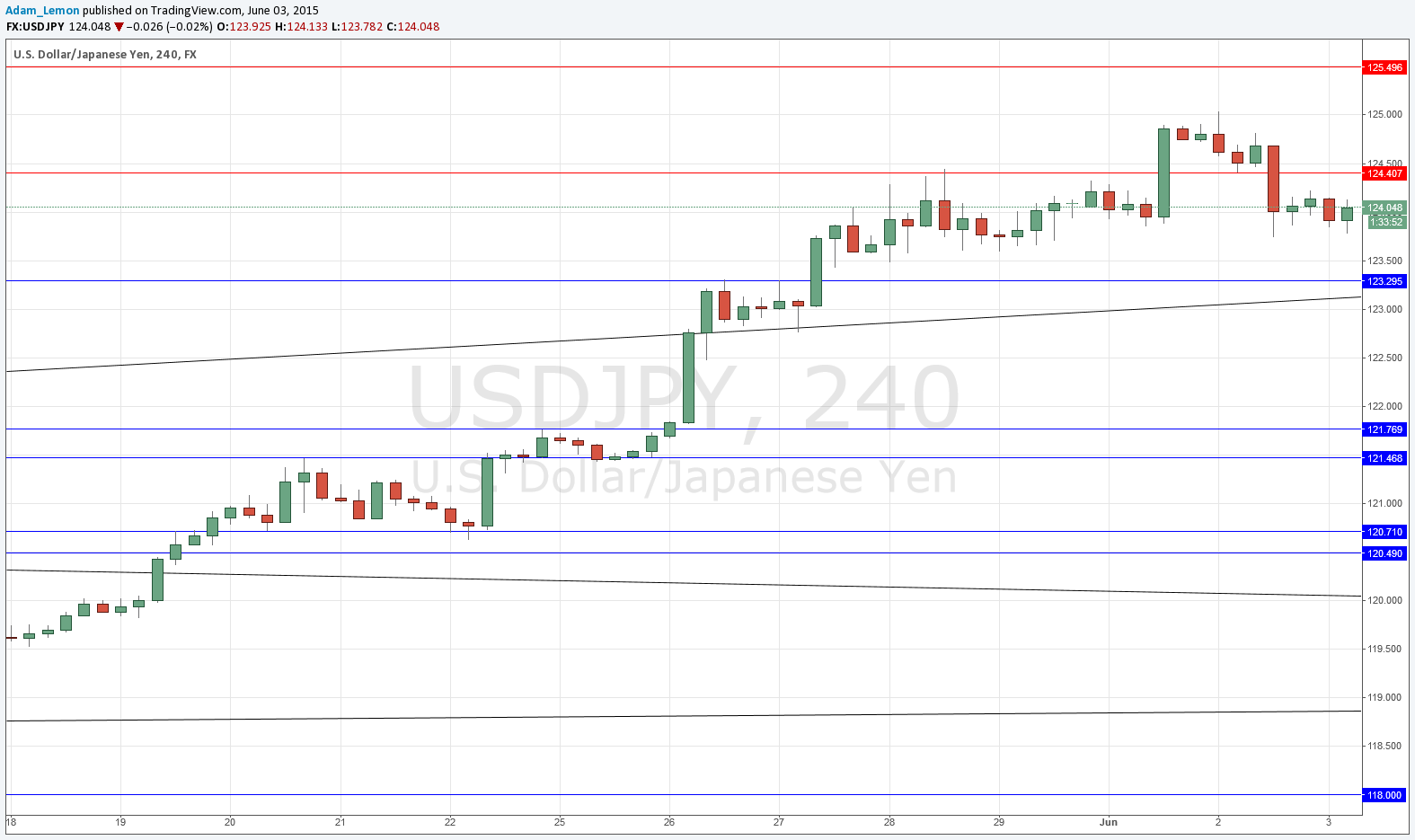

Long entry following a bullish price action reversal on the H4 time frame immediately upon the next touch of 123.30.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry following a bullish price action reversal on the H4 time frame immediately upon the next touch of the bullish trend line currently sitting at around 123.12.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H4 time frame immediately upon the next touch of 124.40.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Short entry following a bearish price action reversal on the H4 time frame immediately upon the next touch of 125.50.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The level at 124.33 which I wrote about yesterday did not hold as support, in fact there is clearly flipped resistance now just a few pips higher at 124.40. However although we did get down below 124.00, there seems to be plenty of support down there, and the price is now rising up to less than 30 pips away from the new resistance at 124.40.

Although things looks short-term bearish, it would not be surprising if we get another push up, as the long-term upwards trend seems far from over. Key levels to watch will be the bullish trend line a little below 123.30 and also 125.00 / 50, in order to determine really major trend developments. However we have a lot of USD news coming up so it makes sense to expect volatility from the New York open today to the NFP release this coming Friday.

There are no high-impact events scheduled today for the JPY. Regarding the USD, there will be a release of ADP Non-Farm Employment Change data at 1:15pm London time followed by Trade Balance numbers at 1:30pm. Then at 3pm there will be a release of ISM Non-Manufacturing PMI data.