USD/JPY Signal Update

Last Thursday’s signals expired without being triggered.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

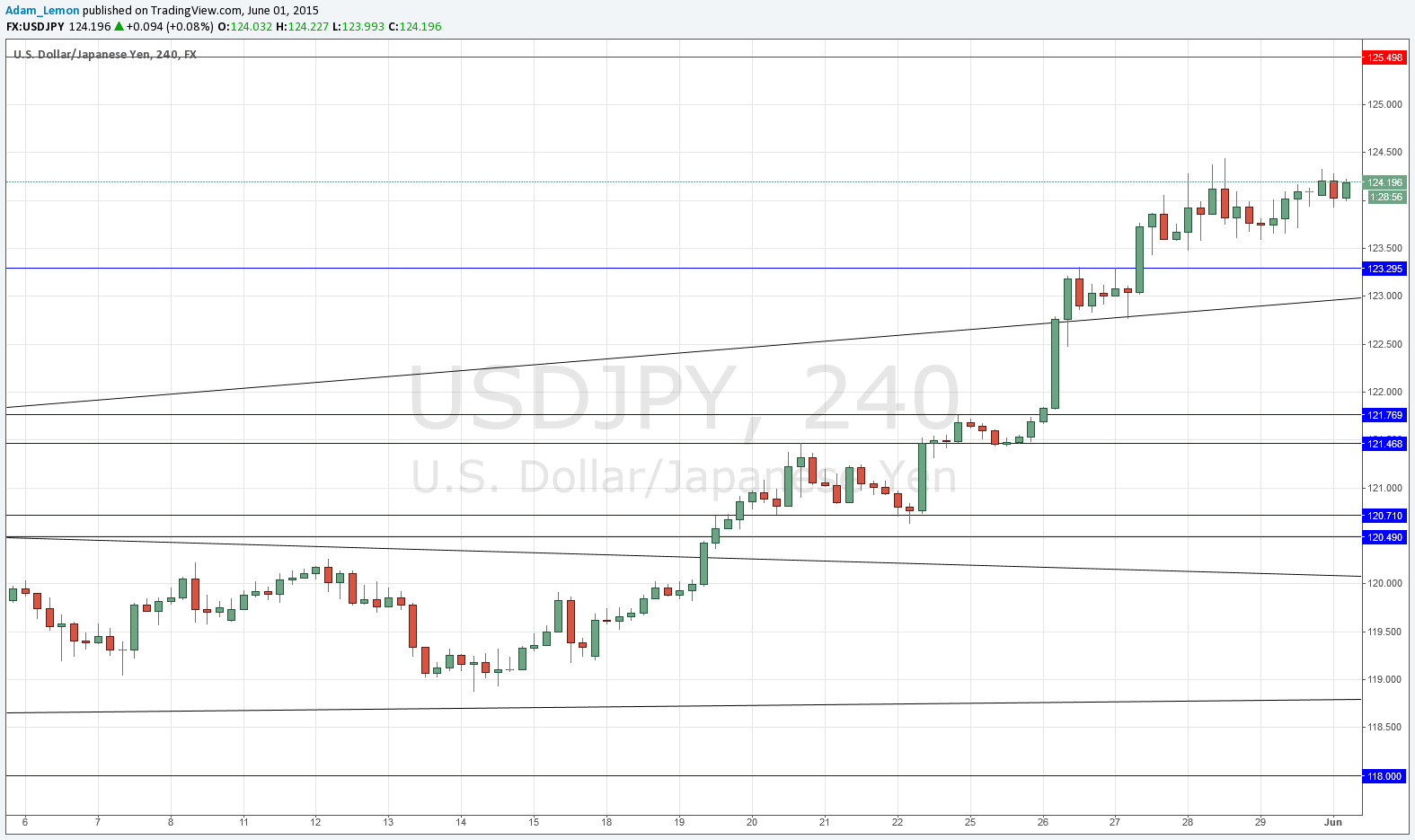

Long entry following a bullish price action reversal on the H4 time frame immediately upon the next touch of the 123.30.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry following a bullish price action reversal on the H4 time frame immediately upon the next touch of the bullish trend line currently sitting at around 123.00.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H4 time frame immediately upon the next touch of 125.50.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The bullishness continues with this pair one of the best placed to benefit from a strong USD, if the strong USD trend does continue. Probably, it will pause for a few days, until we get the big USD news at the end of this week.

We have struggled to make new highs but the pair does keep pushing up which is a bullish sign.

Below us we have a double top at 123.30 that will now probably have flipped to support. Below that there is an old trend line which has also flipped twice, and it should be nicely supportive now as it is confluent with the round number at 123.00.

There will probably be resistance at the psychologically key round number of 125.00 but there is a key level beyond that which is the multi-year high at 125.50.

There is some evidence we are in a resistant zone all the way from 124.13 up to 125.50. The long odds should favour a short reversal from here, but that is against a still-strong bullish trend.

Concerning the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time.