USD/CHF Signal Update

There are no outstanding signals.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be made before 5pm London time.

Short Trade 1

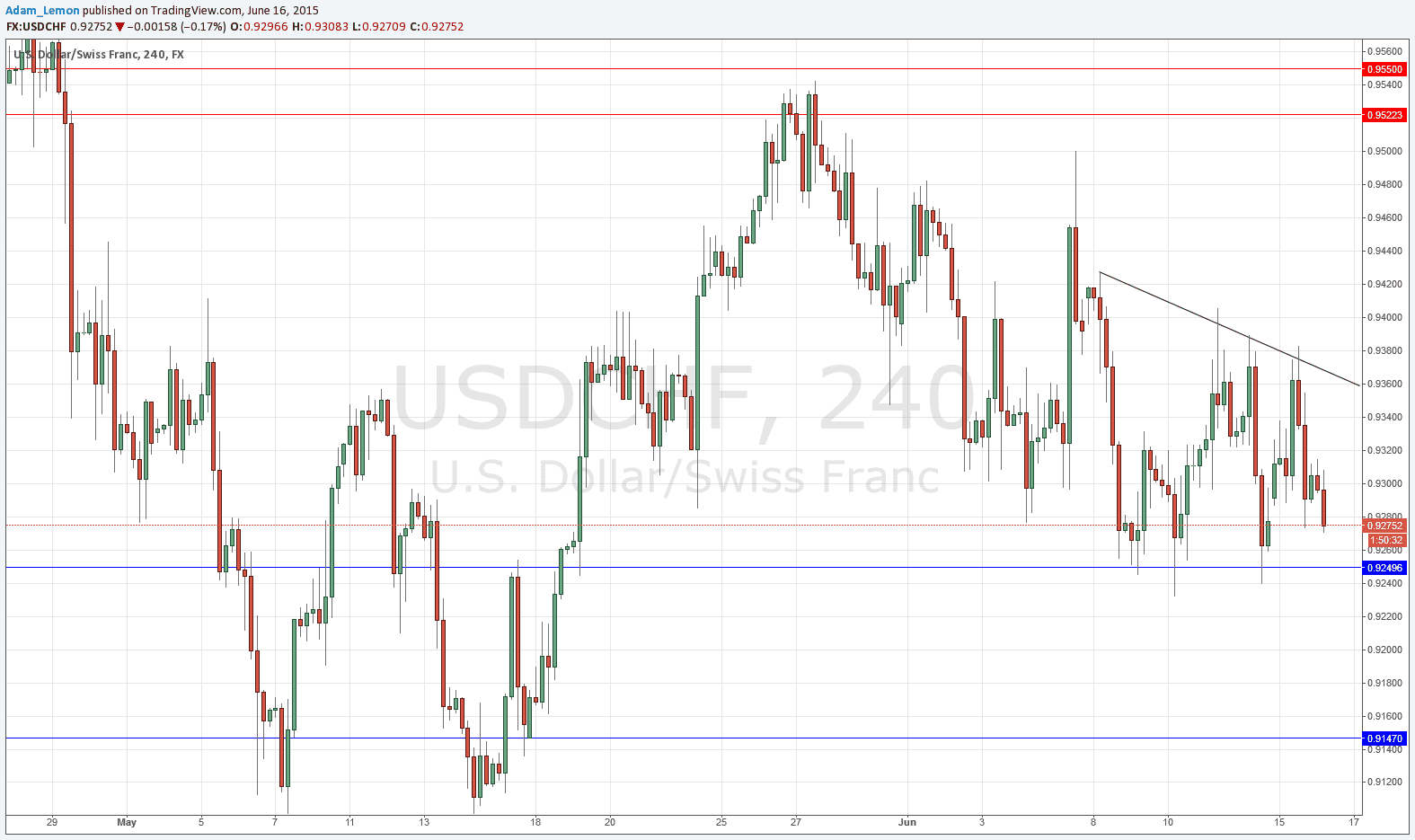

Go short after bearish price action on the H1 time frame following the next touch of the bearish trend line currently sitting at around 0.9365.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of 0.9250.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

For almost an entire month now, the key psychological level of 0.9250 has been acting as support. However, it seems that the level has become more “used” and less and less supportive as time has gone on. Above the current price, we have a bearish trend line that has been compressing the price and driving it down. As we approach 0.9250 again, we may get another bounce, but be careful: a breakdown at this stage is highly possible. A breakout trade could be taken if there is enough momentum, but this is unlikely to happen convincingly today.

A pull back to the bearish trend line could provide another short opportunity. A clear break above that bearish trend line should see the price approach 0.9500 again.

There are no high-impact events scheduled today for the CHF. Regarding the USD, there will be a release of Building Permits data at 1:30pm London time.