Gold prices ended Tuesday's session up 0.3% at $1192.71 per ounce as downbeat U.S. economic data pressured the dollar. The Commerce Department's report showed that new orders for factory goods slumped 0.4% in April. The metal was also supported by concerns about volatility in the global equities and a rebound in the Japanese yen. Although recent developments sparked some safe-haven bids for gold, lackluster physical demand will probably continue to weigh on the market.

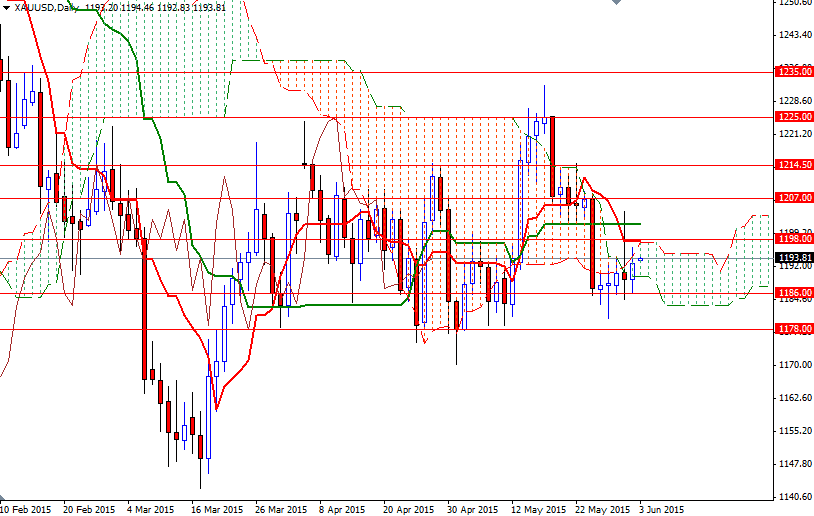

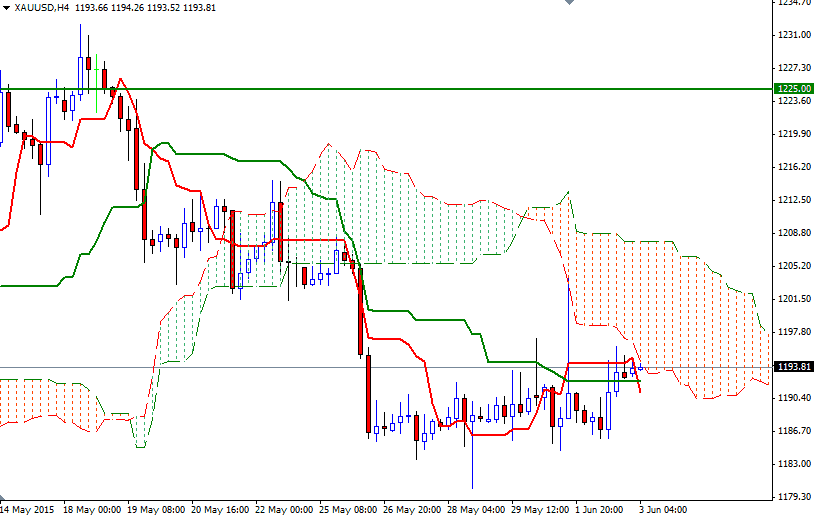

The XAU/USD pair has been bouncing roughly between the 1225 and 1175 levels for some time now and the pattern on the daily chart suggests that gold prices will tend toward consolidation as markets await key U.S. data. We are moving within the borders of the daily Ichimoku cloud while the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are negatively aligned on the weekly, daily and 4-hour charts - definitely not a very encouraging technical picture for the bulls.

If the bulls intend to march towards the first vital resistance at 1214.50, they will have to push prices above the 1201.20 - 1198 area and pass through the 1207 level. Closing above the 1214.50 level would imply that the short-term technical outlook is shifting to the upside. In that case, a retest of the 1225 level might be realistic. However, if the 1198 area, where the top of the daily cloud and Tenkan-sen coincide, blocks buyers' way and XAU/USD starts to retreat, the 1989.63 - 1988 support could be tested. Based on the charts, once gold drops below 1183, the next obvious support level is around 1168/1166.