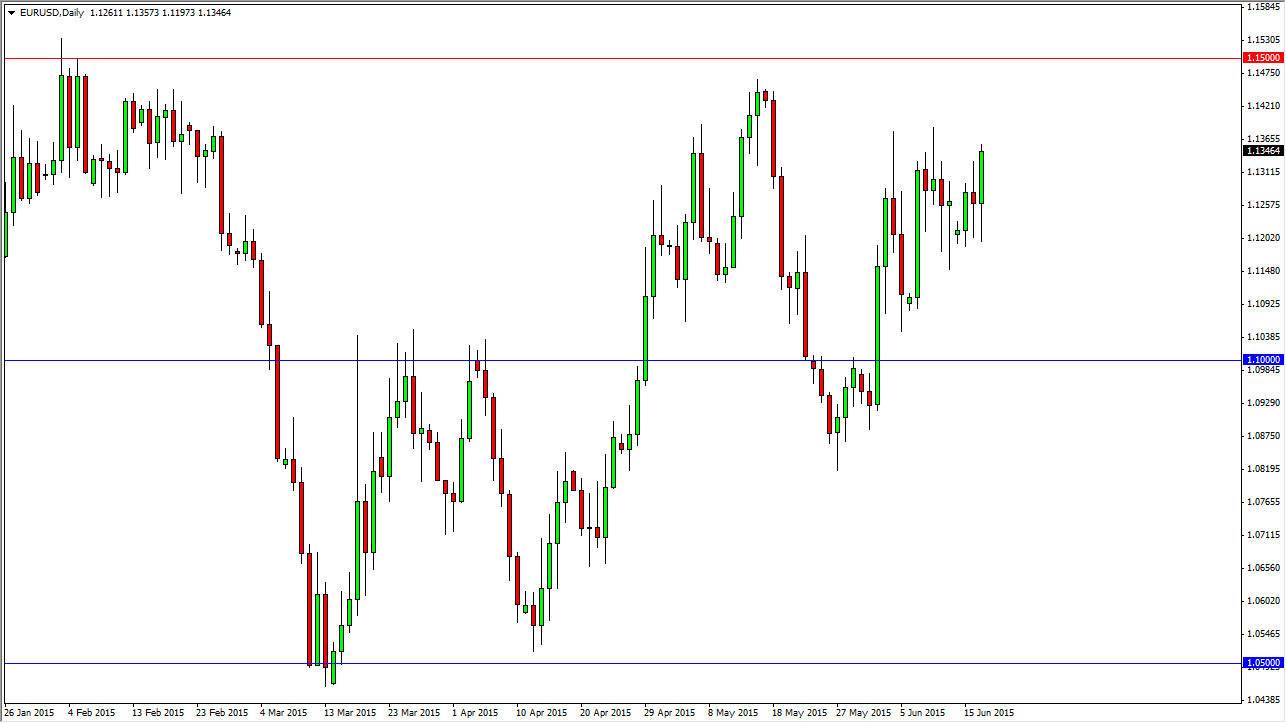

The EUR/USD pair initially fell during the day on Wednesday, but as you can see turned back around somewhere near the 1.12 level. This was predicated upon the consolidation area that we have been in for some time now, but also upon the FOMC announcement during the day. After all, it appears that the United States is still on track to have the “morning done” type of interest-rate hike, and therefore it’s more than likely going to be a higher Euro going forward.

There of course are concerns out of Greece, but at the end of the day that situation tends to work itself out again and again. I think personally that every time the market gets concerned about Greece, you should start looking for value in the Euro and of course European stocks. I don’t have any interest in shorting this market right now, but I do recognize that a pullback could be coming. After all, we are approaching pretty significant resistance.

The 1.14 level

I believe that the 1.14 level starts a pretty significant amount of resistance all the way to the 1.15 handle. If we can break above the 1.15 level, I believe that the trend is now to the upside, and the market will go much, much higher given enough time. On the other hand, a pullback could simply be a nice momentum building exercise to try to break out above that level. Because of this, I am essentially in “buy only” mode at the moment, as we continue to grind sideways with an overall upward bias.

I have no interest in selling until we get below the massive support that I see the 1.10 level, which extends down to the 1.09 level. In other words, we have to make a pretty significant move to the downside in order to have me interested in selling as I think the US dollar has essentially “topped out” at this point and the cycle is starting to turn back in the Euros favor.