EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time today only.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1291.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1311.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of the broken bullish trend line currently sitting at around 1.1350.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

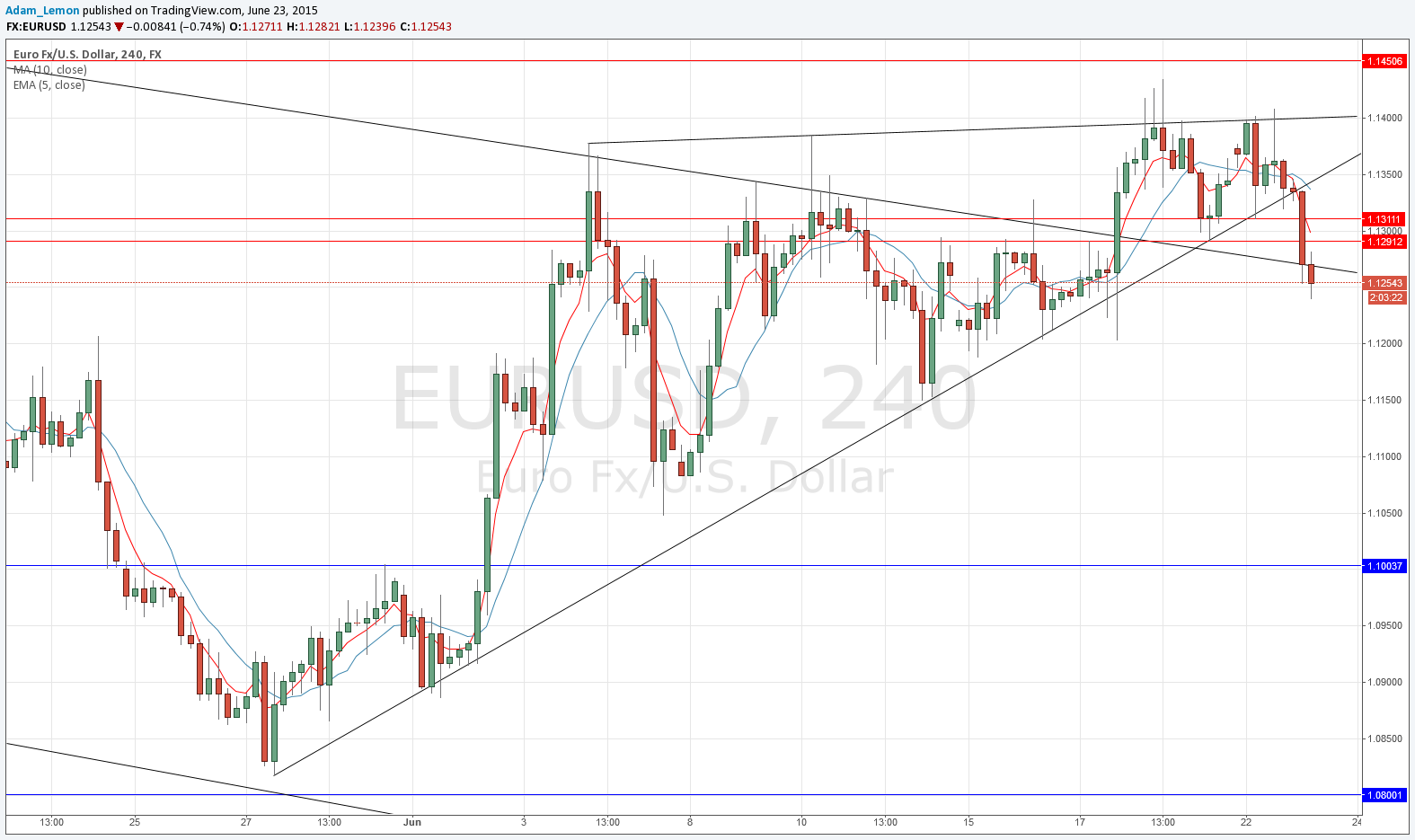

EUR/USD Analysis

This pair is likely to be the main focus of the Forex market today for the second day running. I was correct to name this pair yesterday as the likely centre of the market.

After initially falling yesterday, then rising quite bullishly to test 1.1400, the price fell from the bearish trend line I already had on the chart, and overnight broke through the bullish trend line, which previously had marked the low of the London session. The price also fell cleanly through 1.1291 which I had seen as likely support, so I now flip that to likely resistance.

The price is very close to a broken bearish trend line that has been around for a long time, but I do not have much confidence in this line.

There is probably local support from 1.1250 down to around 1.1200.

Keep in mind that with all the uncertainty over Greece, although this pair should remain active, it is also likely to move very unpredictably.

There are high-impact events scheduled today for both the USD and the EUR. Regarding the EUR, there will be French Flash Manufacturing PMI data released at 8am London time, followed half an hour later by the German equivalent. Concerning the USD, FOMC Member Powell will be speaking at 3pm London time, followed half an hour later by Core Durable Goods Orders data.