The CAD/CHF pair is one that you probably don’t trade very often, but shouldn’t be afraid of doing so. After all, the Canadian dollar in the Swiss franc are both major currencies, and as a result they do tend to move fairly well in relation to the rest of the Forex markets.

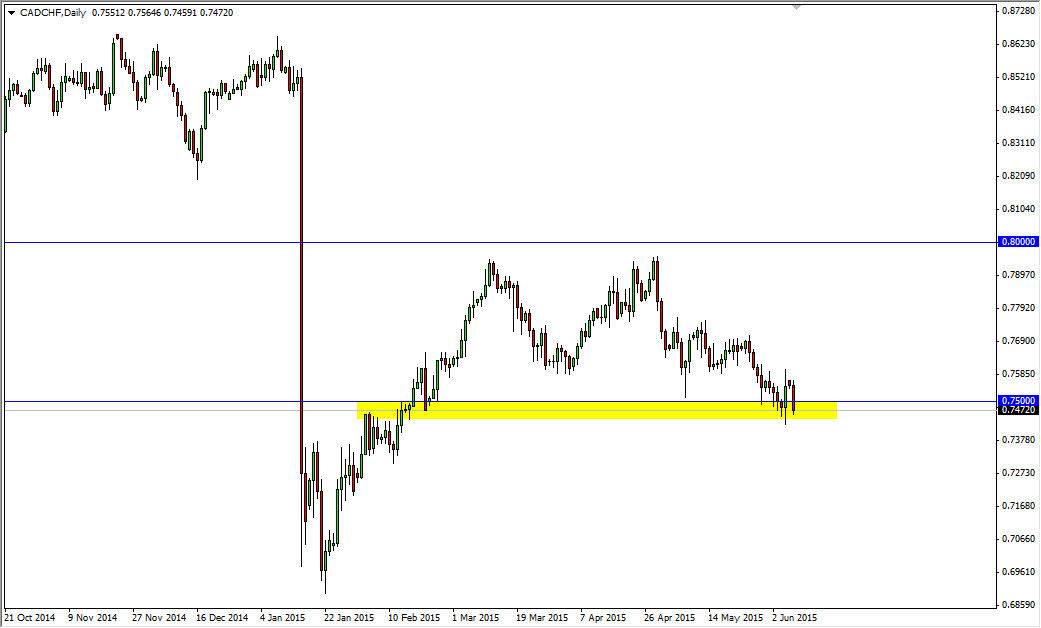

As you can see on the chart, I have a yellow box just below the 0.75 level, which is where we presently trade at the moment. I think that there is a significant amount of support in this general vicinity, and as a result I am waiting to see what happens next. I have to admit though, the Swiss franc looks like it is trying to strengthen around the world, and if that’s going to be the case the CAD/CHF pair won’t be any different. On the other hand, this is an area where we could see buyers step back into this marketplace and push things higher.

Making a decision

I believe that this area is where we are essentially going to make a decision as to where this market goes next. With fact, I am waiting to see if we can break down below the 0.74 handle, which in my opinion is enough of a reason to start selling at that point. On the other hand, if we can break above the 0.76 level, I believe that market would go higher, and perhaps head towards the 0.79 level next. After all, we could simply continue to consolidate in this general vicinity, but I think that it’s only a matter of time before the decision is not only made, but very clear.

If we break down, we should eventually head to the 0.70 level, but it might take a little bit of time to get down there. On the other hand, if we break out to the upside, I believe that it’s we will continue to consolidate between here and the 0.79-ish region as it would simply be a continuation of what we have seen most of this year.