AUD/USD Signal Update

Last Thursday’s signals expired without being triggered as there was no bearish price action at 0.7805.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

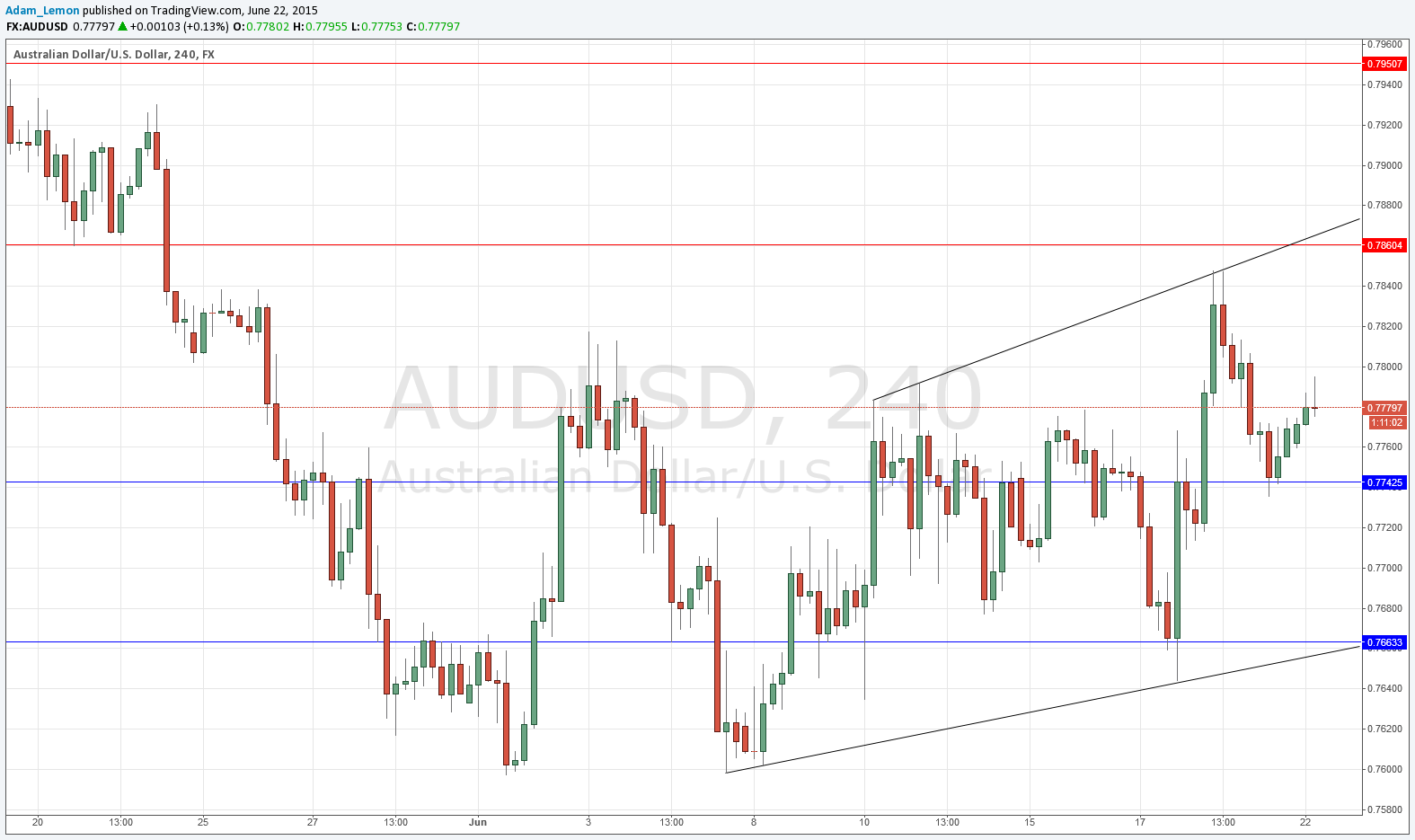

Short Trade 1

Go short following some bearish price action on the H1 time frame immediately upon the next touch of 0.7860.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long following some bearish price action on the H1 time frame immediately upon the next touch of 0.7743.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long following some bearish price action on the H1 time frame immediately upon the next touch of 0.7663.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

The AUD is showing a little strength, although it is not very obvious. It has been basing and should the USD really begin to weaken, could move up from its price, which is relatively low in historic terms.

However for the time being the price is a fairly bogged down, although we are just beginning to see the start of a bullish channel, as shown in the chart below.

There are no high-impact events scheduled today for the AUD. Regarding the USD, there will be Existing Homes Sales data at 3pm London time.