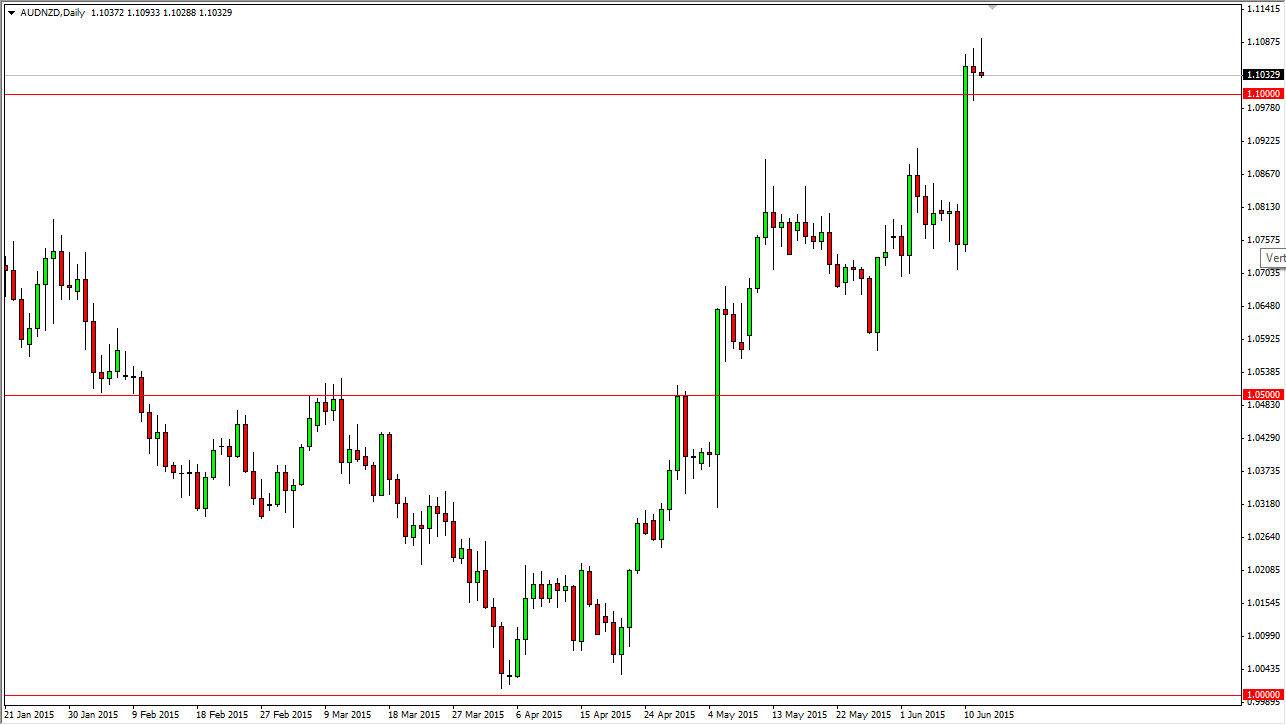

The AUD/NZD pair initially tried to rally during the session on Friday breaking out to a fresh new high. However, we ended up pulling back and formed a shooting star. What I would direct your attention to is the fact that we had formed a hammer during the Thursday session that found support at the psychologically significant 1.10 level. The impulsive candle on Wednesday of course is very positive, and as a result I am only looking to buy this pair. On pullbacks that occur, I believe that it’s only a matter of time before the buyers step back into the marketplace and push prices higher.

Not only that, the NZD/USD pair looks like it’s hanging on by a thread, and if we break down a little bit we could very well find ourselves heading to the 0.65 level. On the other hand, the AUD/USD pair looks like it’s going to consolidate, maybe rise a bit. That shows how much stronger the Australian dollar is than the New Zealand dollar, and that’s really what matters. It’s all about relative strength at this point in time, and this pair certainly is reacting to it.

Buying dips, hanging on

At this point in time, I am buying dips as they occur, and hanging onto this pair as we grind away much higher. Quite frankly, we are at massively low levels historically, and as a result it would make sense if we continue to bounce and it go much higher. I think that it’s only a matter time before the buyers completely take over, and I think we are witnessing a bit of a trend change in this market. With that, I would not only anticipate seeing the AUD/NZD pair go higher, but I would also anticipate the AUD/USD pair outperforming the NZD/USD pair going forward as well. It’s all related in triangulation, something that I talk about from time to time with traders. By looking at this pair, you can often tell which one you want to buy or sell against the US dollars well, and this is a perfect example of that.