USD/CAD Signal Update

Yesterday’s signals expired without being triggered as there was no bullish price action at either of the key levels after the New York open.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be taken before 5pm New York time only.

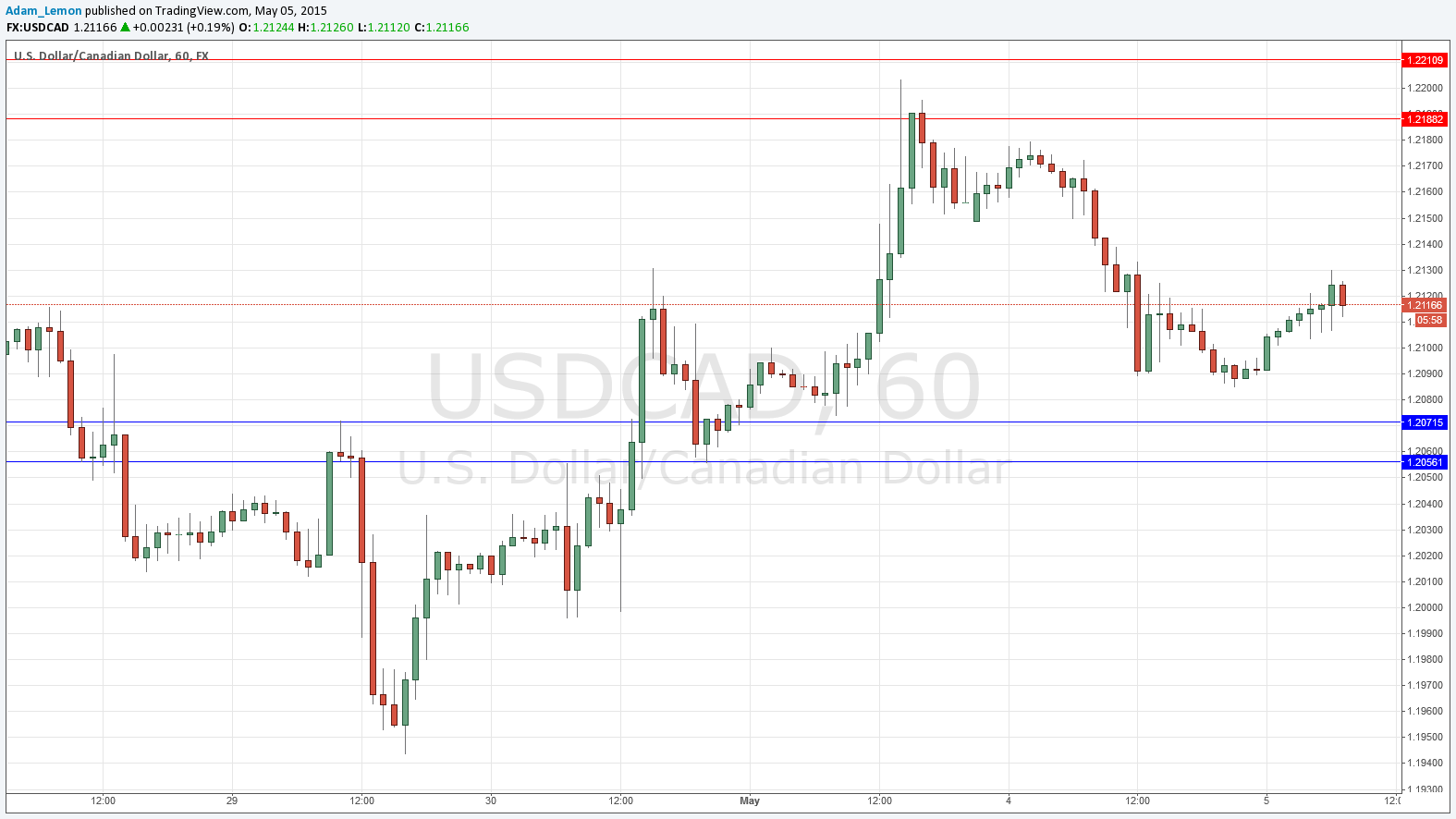

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next entry into the zone between 1.2188 and 1.2211.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Go long after bullish price action on the H4 time frame immediately following the next entry into the zone between 1.2071 and 1.2056.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

After falling somewhat yesterday, the price has been rising, but not very convincingly. The longer-term momentum is definitely to the downside and the current oscillation is probably due to the fact that both sides of this pair will be getting some major news today. A short off a spike up to the 1.2188 zone would probably be a great trade. A break down below 1.2050 would be a very bearish sign.

There are high-impact events scheduled today concerning both the USD and the CAD. There will be a release of both U.S. and Canadian Trade Balance data at 1:30pm London time, followed later at 3pm by U.S. ISM Non-Manufacturing PMI.