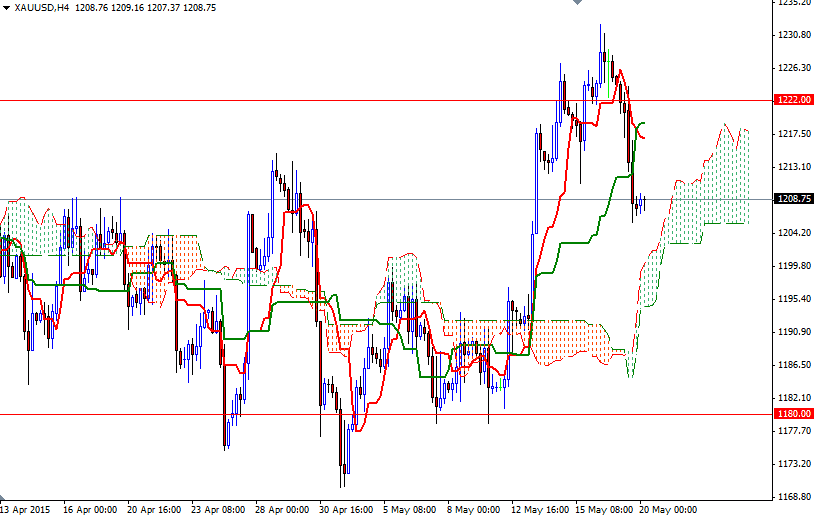

Gold prices fell 1.44% yesterday, snapping five consecutive days of gains, and settled at $1207.53 an ounce as the dollar rallied on the back of encouraging housing data. The XAU/USD pair hit the lowest level in four sessions after the Commerce Department reported that building permits climbed 9.6% to a 1.14 million pace and housing starts jumped 20.2% to a 1.14 million annualized rate in April. Market players were also cashing in recent gains after gold failed to convincingly breach the $1225 key resistance level.

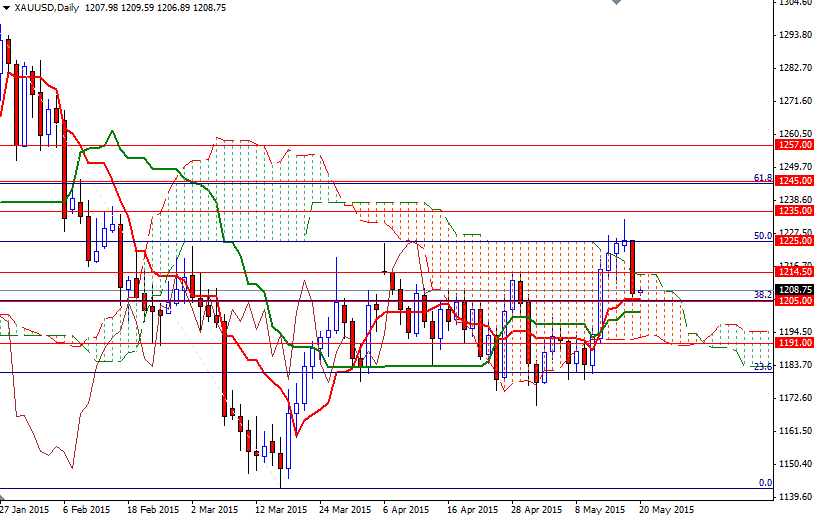

Not surprisingly, XAU/USD accelerated its descent after the supports at 1217.50 and 1212 were broken and returned to the 1207/5 area which the market had struggled to pass through several times during last month. All eyes will be on the U.S. Federal Reserve today, with the release of the minutes of the most recent policy meeting. In the meantime, the market is trying to stay above this strategic (1207/5) zone which holds the key to the 1199 support. Falling through 1199 could open the way down to a further move to the 1192.91 - 1191 levels.

On the other hand, if the bulls intend to take over, they will need to push the market back above the 1214.50 level where the top of the daily Ichimoku cloud sits. Penetrating this barrier might lure additional buyers into the market and increase the possibility of XAU/USD testing the 1218.75 and 1221.61 intra-day resistance levels. Beyond that, we have plenty of hurdles across the road (with the closest being 1225) as the market will trying to pass through the weekly cloud.