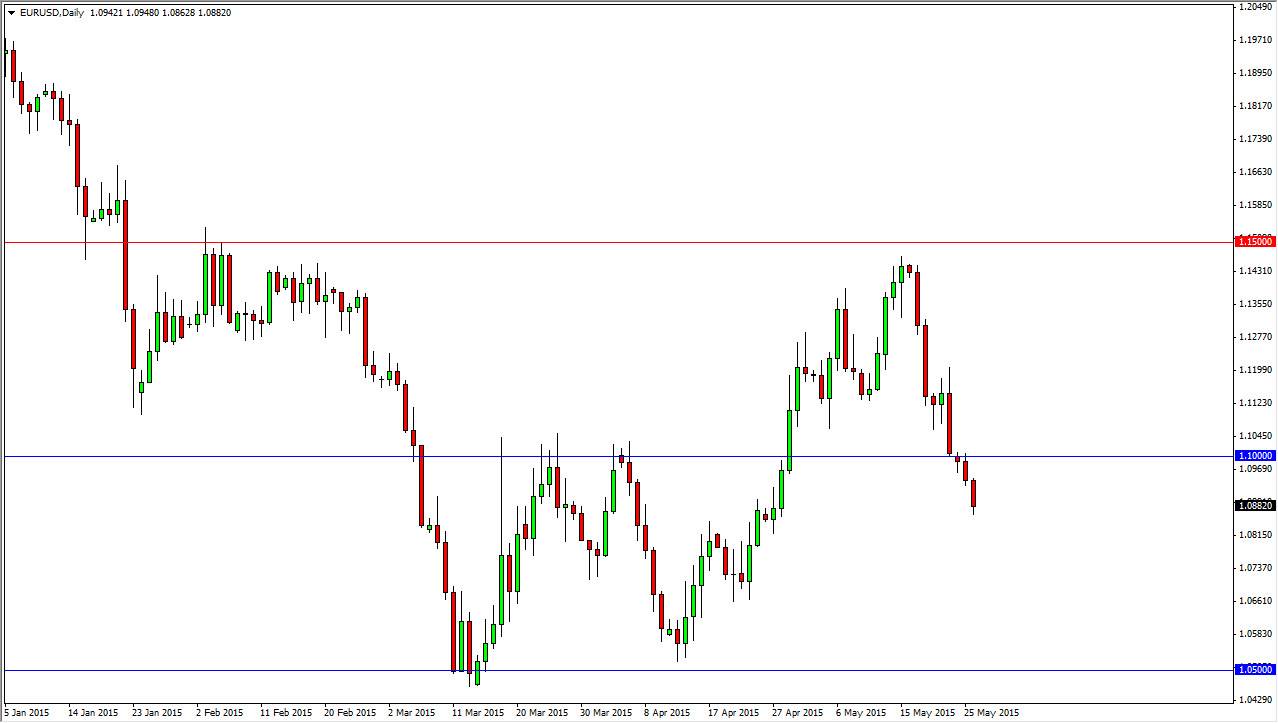

The EUR/USD pair fell pretty hard during the session on Tuesday, as traders came back to work in both the United States and the United Kingdom. Because of this, I feel little bit more comfortable in shorting this market, simply because it shows real strength to the downside now that we have full liquidity.

With that being the case, the market looks like it’s ready to drift lower, perhaps heading down to the 1.05 level given enough time, and therefore I am bearish. I see the 1.10 level above being the “balance” in this market, essentially being “fair value.”

With this, I believe that eventually we will grind towards the bottom of the consolidation area which I see as extending all the way down to the 1.05 level, but I also recognize that there is a lot of noise to be had between here and there. With this, we should see this market continue to sell off every time it rallies, on short-term charts.

Interest-rate expectations

The head of the Federal Reserve, Janet Yellen recently suggested that an interest-rate hike is coming in 2015, and that of course has people buying the US dollar. On top of that, you have all of this nonsense coming out of Athens about not paying loans back, which of course they always back down from. However, this makes people simply get bored of trying to support the Euro, and quite frankly the European Central Bank is probably perfectly fine with that.

Because of this, I feel that this market will more than likely continue to go lower and that following makes complete sense. However, I am cognizant of the fact that a move back above the 1.10 level with any type of strength at all would be very bullish. I am starting to wonder whether or not we are starting to form a consolidation area, with the 1.05 level being the bottom, and the 1.15 level being the top. Perhaps this is the summer range?