EUR/USD Signal Update

Last Wednesday’s signals expired without being triggered as the price never reached 1.1059 during that day’s London session.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time only.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line which is currently sitting at around 1.1035.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1013.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short upon the first touch of 1.1260.

Place the stop loss at 1.1305.

Adjust the stop loss to break even once the price reaches 1.1210.

Remove 50% of the position as profit at 1.1210 and leave the remainder of the position to ride.

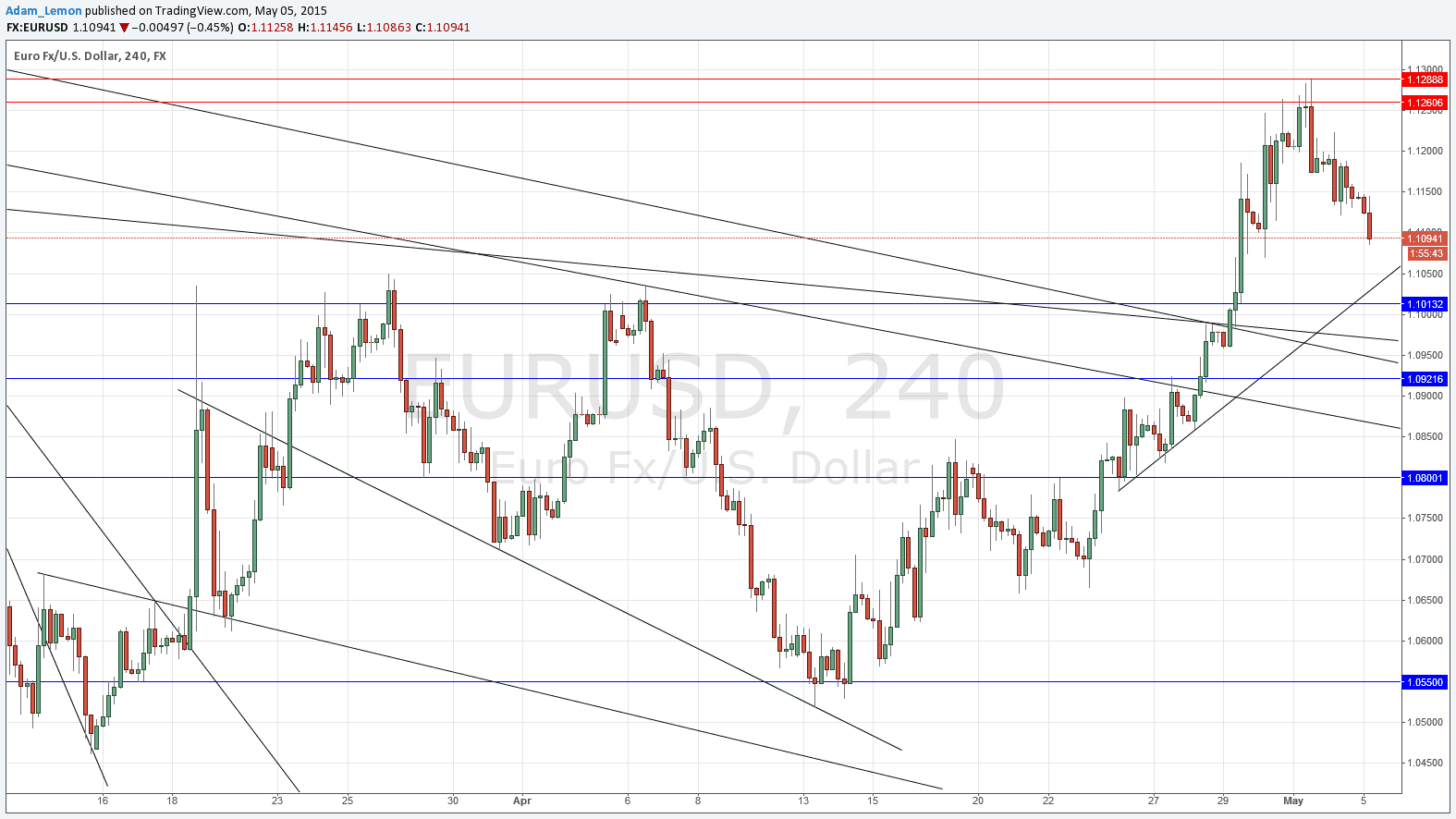

EUR/USD Analysis

Last week saw a strong rise in this pair, but this seems to have peaked now. It is no accident that this peak occurred at around the 1.1250 area as this was a really key support/resistance area before the last dramatic breakdown in this pair a few months ago.

At the time of writing the pair is falling but as London opens that might change quickly. However it really looks as if we are going to fall and test the supportive area at around 1.1035 to 1.1013. If the price can break down quickly below 1.1000 that will probably be a bearish sign. However some consolidation at around 1.1000 is a more likely scenario.

There are a few high-impact events scheduled today concerning both the USD and the EUR. There will be a release of Spanish Unemployment Change data at 8am London time. Later there will be a release of U.S. Trade Balance data at 1:30pm London time, followed at 3pm by U.S. ISM Non-Manufacturing PMI.