USD/JPY Signal Update

Yesterday’s signals were not triggered as there was no bearish reversal off the 119.44 level.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the first test of 119.44.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 119.89.

Long Trade 2

Go long following a bullish price action reversal on the H1 time frame immediately upon the first test of 119.15.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 119.89.

Short Trade 1

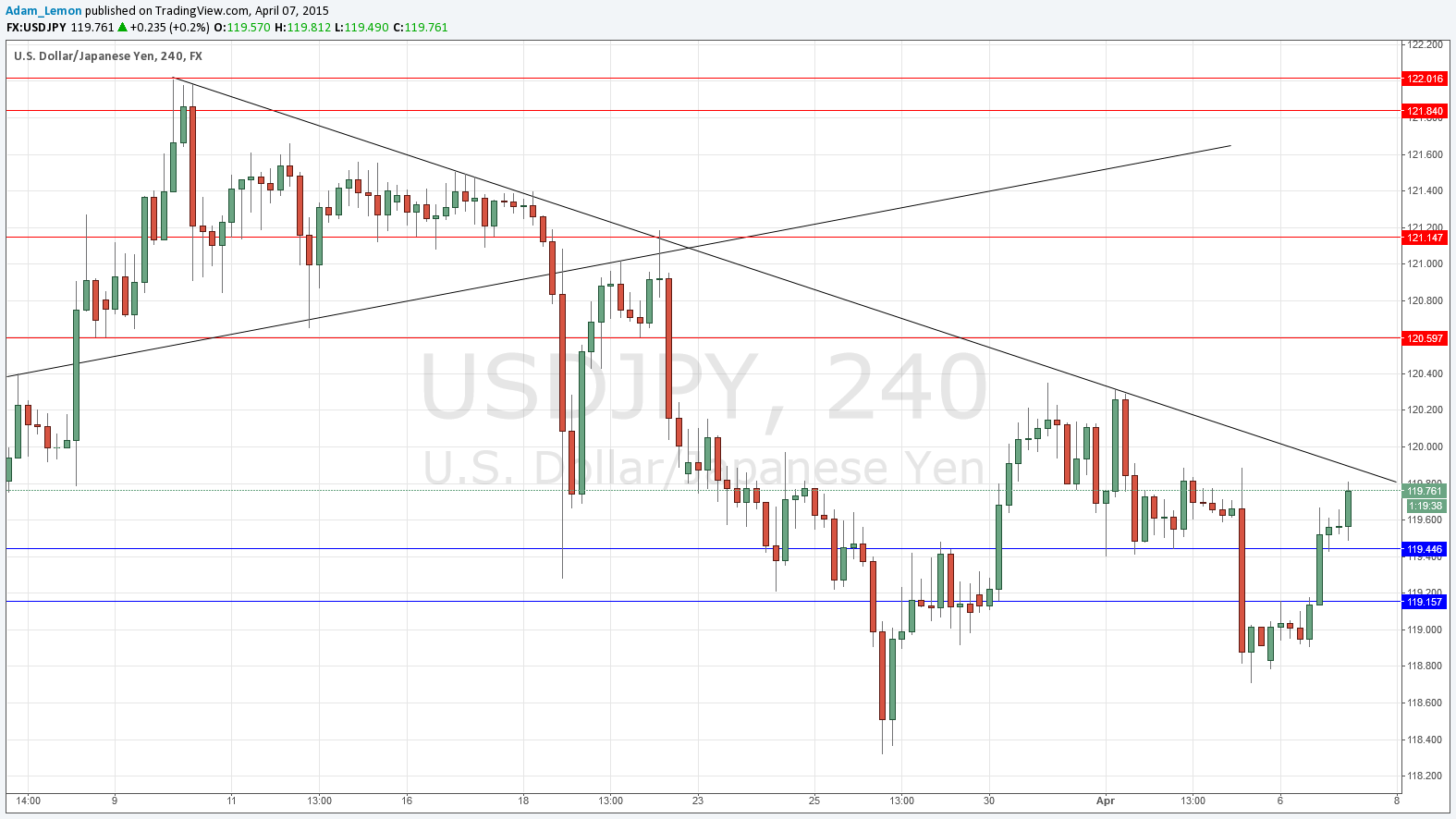

Go short following a bearish price action reversal on the H1 time frame immediately upon the first retest of the bearish trend line currently located at around 119.89.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 119.50.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the first test of 120.60.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride. Take further profit at 119.50.

USD/JPY Analysis

We have seen a fairly strong upwards move in this pair, and we now approach the well-tested bearish trend line that has held for quite some time. This trend line is also fairly confluent right now with the psychologically key 120.00 level. Therefore it could be a good turning point at which to get short.

Below, the previous anticipated resistance at 119.44 has now flipped to support. There is also a likely slip below that at 119.15.

There are no high-impact events scheduled today concerning the USD, but there is regarding the JPY. Late in the forthcoming Tokyo session, the Bank of Japan will be releasing its Monetary Policy Statement.